I'm not terribly surprised that FTD Companies (FTD) has bounced over the past few sessions. As FTD slid below $4 at the end of last month, its equity slice dropped below 40% of total enterprise value. There's still some value here in the namesake FTD brand, along with the ProFlowers, Shari's Berries, and Personal Creations nameplates. Qurate Retail Group (QRTEA) (QRTEB), formerly Liberty Interactive, owns 37% of the company, raising hopes of a rescue a la QVC. And new management's aggressive targets suggest at least a hope of a turnaround which would lead to massive upside in FTD shares.

And as bearish as I've been on FTD - a sentiment I've maintained as the stock dropped 70% last year - I admit to being intrigued myself. I gave some thought to buying FTD last week after Q4 earnings contained no negative surprises, which for the stock counts as progress. Even with the rally, there's still a case that risk/reward for FTD is worth taking - personally, after the last few quarters, the question likely is whether I can talk myself into it.

The Bear Case

Given that FTD is down ~75% over the last year, it's worth considering the risks first. Broadly speaking, there's a clear chance is 100% loss of capital: Liberty or no Liberty, there's a path for FTD to get to zero.

The company already is likely to violate covenants in its debt agreement, which led to a 'going concern' warning in the 10-K. The net leverage ratio is over 3x, based on post-Q4 guidance pointing investors to the low end of Adjusted EBITDA guidance of $52-$62 million. That guidance suggests a dramatic plunge in profits: Adjusted EBITDA was $120 million in 2016, and thus is likely to decline by more than 50% in just two years. And pretty much all of the decline has come from steadily compressing EBITDA margins:

- 2015: 10.24%

- 2016: 10.68%

- 2017: 7.36%

- 2018 (low end of respective guidance ranges): 4.89%

Knock margins down another ~200 bps - hardly impossible for a low/negative-growth, fixed-cost business model - and even without a revenue decline, suddenly FTD's leverage is over 5x, and its solvency is in doubt.

That might seem ridiculous for a company with an enterprise value of ~$300 million that paid $430 million for Provide Commerce less than four years ago. (Most of the consideration admittedly was in FTD stock, which is why Liberty has such a large stake.) But fundamentally, FTD clearly has some level of solvency risk, beyond the 'going concern' issue which the company expects to resolve relatively quickly.

Bankruptcy aside, the falling margins and profits show another problem for the bull case. It's not as if investors are necessarily fleeing the stock and making it 'cheap'. The stock has fallen because a) profits are falling and b) it has (now) a reasonable amount of leverage. A year ago, FTD traded at about 7x forward EBITDA; in December, the multiple was at 5.4x. The figure now is about 5.7x, using the low end of CY18 guidance.

That's a notable discount to both the historical range and to rival 1-800-Flowers.com (FLWS), who trades at about 8x. But FLWS has net cash, and no investor at the moment would suggest FTD deserves to trade in line with either FLWS or its past valuations. Meanwhile, the leverage and EBITDA declines combined are crushing free cash flow, which offsets what looks like a ridiculously attractive P/FCF multiple on a TTM basis. FTD trades at 2.8x CY17 non-GAAP free cash flow, and about 3.6x the reported figure. But 2018 guidance suggests normalized free cash flow this year will be roughly zero, or maybe modestly positive.

In other words, this isn't a case where investors are fleeing the stock because of fears of what will happen beyond CY18, or in response to some hypothetical competitive threat down the line. Most of the decline in FTD stock is readily explainable from a textbook fundamental standpoint - and most of it is coming from lower earnings and cash flow, not multiple compression.

The third problem is that the business itself isn't all that attractive, one reason why I've stayed away from FTD as it's become progressively cheaper. The core model is ripe for disruption. The Florist segment now is the most profitable - but florists don't actually like FTD, and the number of florists in the U.S. continues to decline (as does the number of FTD customers in that business).

FTD has some self-inflicted wounds, to be sure. But even at peak performance I still question whether anything more than low- to mid-single-digit revenue growth and maybe some ground-out margin expansion really can be expected in the industry. (1-800-Flowers.com is targeting 5% annual top-line growth.) From a valuation standpoint, FLWS - who is performing reasonably well, and whose stock is not far from a post-crisis high - trades at 8x EBITDA, and probably low- to mid-teens EPS once it uses its proceeds from its sale of Fannie May. Even if the turnaround at FTD has some success, is it a business investors really want to own long-term? And if not, is it worth the myriad risks of trying to time the bottom here?

The Bull Case

But, man, is FTD cheap. And there are few stocks with the potential upside that FTD has:

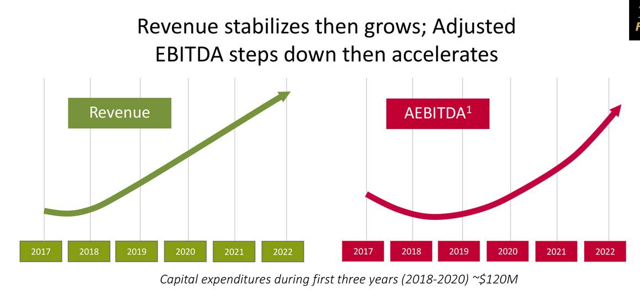

source: FTD investor presentation, January 2018

source: FTD investor presentation, January 2018

Management targets are just that - targets - but if there's even a chance FTD management is right, that alone makes FTD attractive. $135 million in Adjusted EBITDA at 7x would value FTD around $34 (assuming the $160M in net debt is offset over the next five years, which given likely FCF generation is reasonable); at 8x, FTD is worth $39.

Those prices represent 600-700% upside (!) over the next four-plus years. And in the model, EBITDA margins still only get to 9% - lower than past double-digit-plus levels and a point below FLWS' target of 10%. It's not guaranteed that FTD will hit these targets, or come close - but on their face, the projections are not absurd, pie-in-the-sky figures that require some sort of unprecedented performance.

Again, that doesn't mean management's model is correct. But simply from a risk/reward standpoint, the odds of the model being correct don't have to be very high to make FTD a buy (if a high-risk one) at the moment. "Heads I win 6-7x my bet, tails I lose 1x" is a worthwhile gamble, even if the coin is weighted against the gambler.

And there is a case for something less than a multi-bagger here - but still more-than-adequate returns. In the past fourteen months, FTD has added a new CEO, CFO, COO, and Chief Marketing Officer. Stretching a bit further, the CIO and head of supply chain came on in late 2016. One would think Liberty approved of those changes - and one would think the company might be interested in betting on those new hires to execute a turnaround. It's worth noting that per FTD's 10-K, Liberty Interactive/Qurate changed its plans to send its FTD shares out in the GCI Liberty (GLIBA) (GLIBB) (good Lord, is Liberty confusing) split-off, keeping the stake in-house instead. And after Liberty took over the rest of HSN - a business I thought was in decline - last year, a similar move to salvage something out of FTD wouldn't be shocking.

Such a deal seems unlikely in the near term; would shareholders really accept, say, $8-9, even if that suggests a substantial premium to the current price? It would be a hard sell at this point for management to target numbers that suggest a $30-$40 share price and then accept an offer for ~a quarter of those prices. But if FTD has to pull those targets down somewhat - while still making some progress - perhaps Liberty might step in down the line.

Liberty's ownership provides more support for the case that FTD can post reasonably significant gains if it can just get the business fixed a little bit. 2018 EBITDA guidance looks awful - but it's not necessarily reflective of the company's earnings power. FTD is making a number of investments into its business to fix up weakness. An incremental $8-10 million is going into marketing, another $7-9 million into IT, and capex is rising as well. The opex spend alone accounts for over half of the year-over-year guided decline in Adjusted EBITDA.

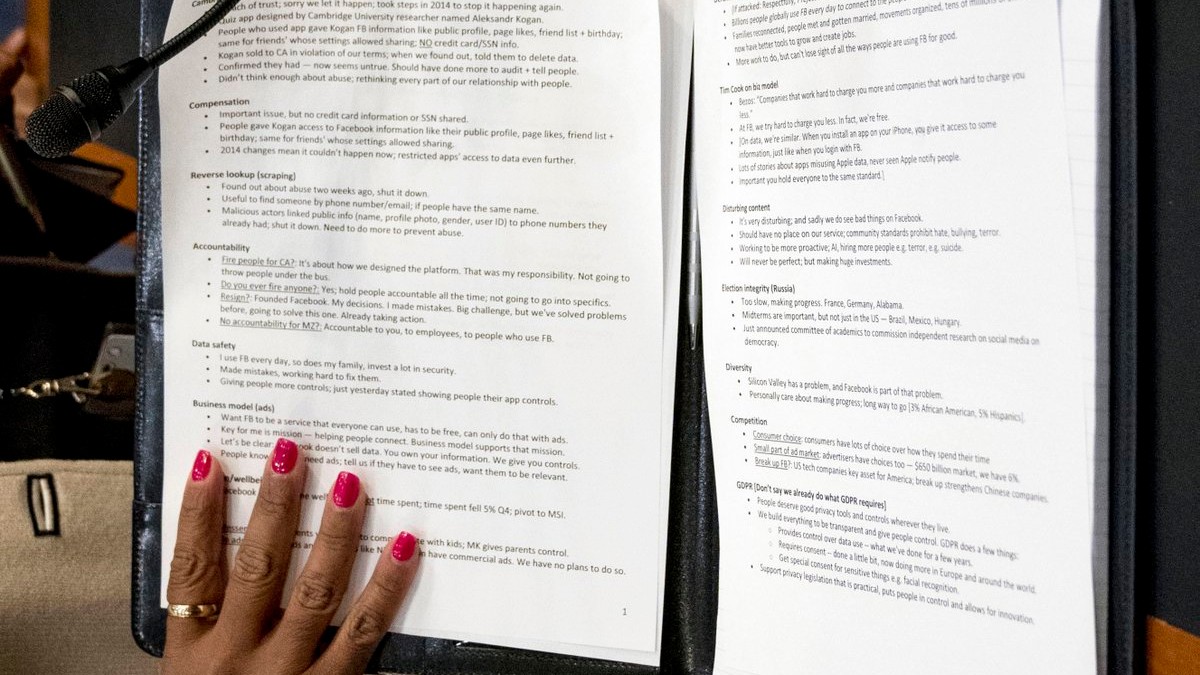

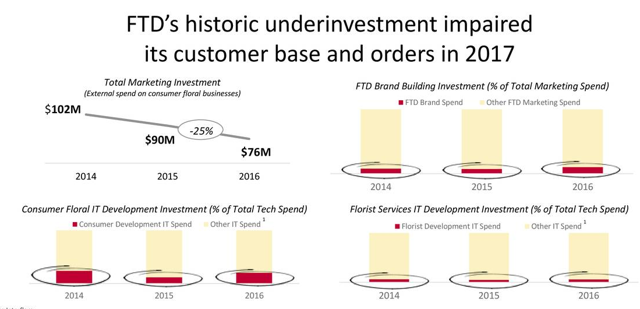

Indeed, the argument from CEO John Walden, who took over last March, is essentially that the business was a mess. The company underinvested in key areas. It didn't spend enough on marketing, and the lower number of customers acquired in past years is undercutting repeat business at the moment:

source: FTD investor presentation, January 2018

source: FTD investor presentation, January 2018

The fulfillment experience has been substandard (at best), leading to poor perception among customers, and, again, lower business at the moment. And so FTD has to ramp up marketing spend this year and increase headcount. Those investments are compressing margins - again, down 500+ bps in two years - but the effect should reverse as they pay off and FTD can ease off the throttle a bit:

source: FTD investor presentation, January 2018

source: FTD investor presentation, January 2018

One notable concern here is that FTD already is off to a bad start. In releasing preliminary Q4 results in early March, the company admitted that it had a disappointing Valentine's Day. And as an analyst pointed out on the Q4 conference call, FTD ramped marketing spend in each of the last two years - only to see revenue declines continue.

This time around, Walden said basically that the Valentine's Day season was a "learning experience". FTD simply isn't ready for growth yet. The company tried to run a dual ad featuring ProFlowers and Shari's Berries, and while more combination sales were made, the individual units still showed weakness. As a result, FTD is going to take a "different risk profile" ahead of the key Mother's Day holiday next month.

But that would suggest that growth expectations have to be moderated - less risk, less reward - and even the interim between preliminary Q4 results on March 7 and the actual release on April 2 shows a weakening business. The company went from pointing investors to the "lower half" of full-year guidance in March to the "lower end" in the April release. And as another analyst pointed out, FTD's language seemed to imply that the potential covenant violation might come sooner than it had seemed just a month ago. All told, it looks like Q1 performance was worse than even management, who is taking a conservative view of the business, expected.

Near-term worries aside, this remains a long-term overhaul of the business, touching everything from marketing to customer fulfillment to the supply chain. A miss on marketing for one holiday isn't necessarily fatal to that case. A sub-$5 share price means that turnaround doesn't have to succeed anywhere close to the manner in which management is projecting. And there are some potential near-term benefits on the way.

First, FTD is assessing strategic alternatives for the Personal Creations business. That business actually is growing, with a CAGR of 6.7% the last two years according to the 10-K, and a 10% growth rate from 2013 to 2017, per the above-linked presentation. FTD hasn't broken out profit from the business, but it generated $115.9 million in revenue in 2017. That's about 22% of the Provide Commerce segment's total; assuming margins in PC are equivalent to the rest of the segment, EBIT in 2017 was in the $6 million range, and EBITDA probably is $8-9 million assuming lower D&A than FTD as a whole.

Could FTD get $60 million for Personal Creations? That would represent a 7-8x EBITDA multiple, and roughly 0.5x sales. That valuation is roughly in line with FLWS - but PC's growth actually is better. Without knowing the margin profile, it's a guessing game - but Personal Creations can materially help the bull case here.

For one, any sale at a reasonable price would remove the covenant issue. $60 million would knock FTD's net leverage ratio down toward ~2.2x; even $40 million would get it under 3x, comfortably below the 3.25x (gross) level mandated under the company's credit agreement. Secondly, PC even at $40 million would bring in 13%+ of the company's enterprise value and ~30% of the market cap, and almost certainly would sell at better multiples than FTD as a whole currently trades at. And third, it could save a couple of million in annual interest - no small feat against a ~$140 million market cap.

More broadly, a sale of Personal Creations could give FTD some time and breathing room. With the 'going concern' issue gone, the turnaround story can drive the narrative here. And if the going gets really tough, there's still the UK-based Interflora business, whose revenues actually have ticked up (if modestly) in local currency the last two years and had a solid Valentine's Day, per the Q4 call. It likely is generating $20 million-plus in EBITDA ($16.8 million in 2017 EBIT). Push come to shove, FTD would seem to have a reasonable chance to erase its net debt of $160 million by selling PC and Interflora, which combined likely have ~$30 million in EBITDA. That would leave a well-known brand with no debt selling for under 0.2x revenue and likely ~6x depressed EBITDA.

Is FTD Worth The Risk?

So while there's a material risk of bankruptcy here, FTD also has avenues to avoid that outcome. Qurate could step in with a takeout or an equity infusion. PC could be sold; a sale of Interflora wouldn't necessarily disrupt the long-term turnaround plan. That doesn't necessarily mean that $4.90 is a floor, but it does mean FTD should at least have time to execute on its turnaround, and that a restructuring is highly unlikely in the near- or even mid-term.

And really, even if FTD stabilizes its business at a lower level, there's room for some upside. Something like $40 million in EBITDA a year, assuming PC goes for $50 million, at a 7x multiple still would value the stock at $6. Capex will come down likely starting in 2020, and FTD could start to deleverage. (This still is a business that throws off a lot of cash, the current capex spike aside.)

There's simply a lot of paths to grinding out some upside without a turnaround, and huge upside in the eventuality that Walden's ambitious plans bear some fruit. I'm truthfully rather skeptical on that point, but at the least customer (and employee) reviews show there is significant room for improvement on the operational front. Given that FTD should have enough time to work on that improvement, and given the possibility of alternate ways (an Interflora sale, help from Liberty) to drive some upside, FTD really does look rather tempting at the moment.

Thank you for reading this Seeking Alpha PRO article. PRO members received early access to this article and get exclusive access to Seeking Alpha's best ideas. Sign up or learn more about PRO here.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in FTD over the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

from Seeking Alpha Editors' Picks stocks https://ift.tt/2a97jA2

via IFTTT