Right now, the market basically is saying that it doesn't believe The Children's Place (PLCE) management. That's true from a short-term standpoint: before recovering a bit over the past three sessions, PLCE fell 10%+ after a Q1 earnings miss, though PLCE (mostly) reaffirmed FY18 (ending January 2019) guidance and chalked the weakness up to a nearly unprecedented impact from bad weather.

It's true from a long-term standpoint as well: PLCE has announced a target of $12 in EPS by 2020. Assuming that target were hit, a 15x multiple plus net cash - in line with PLCE's current valuation relative to the midpoint of FY18 guidance, even with the stock near a six-month low - would value PLCE at about $180, or ~$149 discounted back two years even at 10%. Essentially, the market is saying either that The Children's Place will miss its targets - or that growth will come to an end pretty much immediately come FY21.

As a longtime (and continuing) retail bear, I certainly understand the skepticism. But as I wrote back in January, I also think very highly of PLCE CEO Jane Elfers. The performance of The Children's Place under Elfers suggests it makes some sense to give the company a pass for Q1 - and to accept its explanations at face value.

As far as the long-term target goes, this isn't the all-too-common case of management picking a round number for EPS that would be a nice level to reach. Most of the projected operating margin expansion - 330-350 bps from a guided 8.5-8.7% in FY18 to 12% two years later - is coming from two fairly certain and logical areas. And the company has been earlier than most in recognizing the pitfalls of brick-and-mortar retailing (Elfers' commentary on the Q2 FY17 conference call is required reading for anyone interested in the sector) and in moving aggressively to set itself up to succeed in the new environment.

All told, from here, PLCE now looks like an attractive buy - even to a retail bear. The current valuation should hold barring an outright collapse. And if management is right - and I think they should be given the benefit of the doubt - there's a reasonable case for 50% upside over the next two years.

Q1 Earnings

There's no doubt that PLCE's Q1 report was ugly. Comps declined 1.8%, which looks to be about 2 points below the Street, and much worse than post-Q4 guidance for a "low single digit" increase.

Adjusted EPS of $1.87 doesn't seem that bad, dropping 4% year-over-year. The figure was well below guidance of $2.12-$2.22 and consensus of $2.21, but given the disappointing comps and quarter-end inventory clearance, a modest decline Y/Y hardly appears to be dramatically out of line.

But PLCE also received a huge benefit from taxes on share-based compensation. Adjusted operating income fell by nearly half, with adjusted gross margin falling 220 bps to 37% and adjusted SG&A climbing 11% on flat sales. This looks exactly like the type of quarter that sent so many retail stocks tumbling over the past few years: deleveraging from disappointing comps echoing down the P&L and sending earnings down much more sharply than a 'small' top-line miss might suggest.

The question is to what extent Q1 was just a one-off stumble, particularly due to weather. In the Q&A of the Q1 call, Elfers said that in 33 quarters with the company,

I certainly have never experienced the weather quarter [sic] that even approaches what we just went through in Q1...We are not just talking about having a bad snow pattern in the Northeast for a few weeks; we are talking about 12 weeks of weather impact mostly all of our major markets, one way or the other...

And on the call, PLCE broke its practice of not giving monthly results in pointing out that March comps were +11% (thanks in large part to an Easter shift), while April was -23% through the first three weeks - and plus 24% in the last week, when the weather finally cleared up. Quarter to date (16 days as of the call), the +24% figure had held, with what Elfers called "a significant increase in pent-up demand for our seasonal product."

PLCE now is guiding for "high single digit" comps in Q2 - and actually raised its full-year comp guidance by a point (3.5-4.5% versus 2.5-3.5% previously) coming out of the quarter. Operating margin for the year has been pulled down, as has the tax rate, which nets out on the EPS line, leaving full-year guidance unchanged.

As for the margin pressures in the quarter, they're easily explainable. SG&A jumped due to previously communicated investments in the company's "transformation" initiatives, such as improving digital capabilities and implementing free everyday shipping through the company's website. Gross margin was weak because PLCE had to clear inventory toward the end of the quarter.

There's a pretty solid case here that Q1 really shouldn't have led to much of a sell-off at all - if management is to be believed. Admittedly, there's also a case that it's dangerous, particularly in retail, to accept weather excuses on face value. (I'd note that Tractor Supply (TSCO) management had similar trust - and that company started talking up weather as comps began to decelerate in 2016. TSCO would lose almost half its value, though it's since rebounded.) And at least until last week, it looked like the investors decided not to take that risk.

An Improved - And Attractive - Business

Still, at this point, after the performance of late (particularly given exposure to the struggling mall space), I'd argue Elfers and PLCE management deserve at least some benefit of the doubt. Comp growth has inflected, turning positive in FY14 (ending the following January) and accelerating to 4.9% and 5.8% the past two years after back-to-back 0.4% prints. PLCE actually has guided rather conservatively, particular in terms of same-store sales, beating initial targets in three of the four years (and handily the last two).

Admittedly, there's been some help to the numbers, particularly of late. The company re-launched its loyalty program in Q3 FY16, adding a private label credit card as well. Store closures have benefited comps, as some of those foregone sales have been recaptured by other stores and/or online. And last year's bankruptcy of Gymboree provided as much as a 2-point push to comps (with the impact being lapped over the next two quarters). Even considering those tailwinds, however, PLCE seems to be performing well particularly relative to the space.

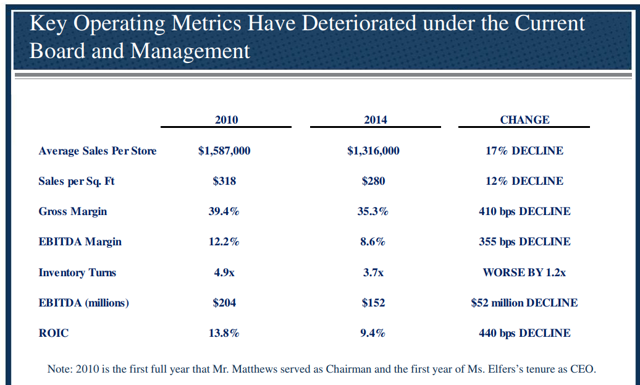

Carter's (CRI) is growing overall sales faster, but mostly through new stores: its comps have lagged PLCE the last two years. Ascena Retail Group's (ASNA) 'tween' business Justice is hemorrhaging sales, with revenue down 20% over the past two fiscal years before stabilizing through the first two quarters of FY18. PLCE seems to be outperforming: a notable reversal from the market share erosion Nitin Gulati highlighted on this site back in 2015. Back then, PLCE was in the middle of a tough activist battle (it eventually settled, giving up two board seats) - and the dissidents had quite a bit of ammunition:

Source: Shareholders For Change at The Children's Place

But the turnaround has taken hold - with much of the credit going to Elfers, as Retail Dive pointed out in March. Margins have expanded (though gross margin of 38.1%, adjusted, is still below FY10 levels - though that's not a huge surprise or disappointment in the retail space right now, and is due in part to higher e-commerce penetration), and sales trends have improved. PLCE has significantly upgraded its technology, driven sharp e-commerce gains: the digital business now accounts for 26% of total revenue, per the Q1 conference call.

This now looks like an attractive business. A 100% foreign (and directly) sourced business might raise trade war risks - but one wonders whether politically, a tariff on children's clothing seems likely. PLCE also has a diversified supply chain, with five different countries accounting for at least 11% of purchases, per the 10-K. (China is the largest, at 19%.) Those relationships are valuable - and difficult to replicate - in a space with low price points where products generally are bought for need, not necessarily for fashion. Children's clothes don't last long - and PLCE's website currently is advertising $5 polos and $2.99 graphic tees.

Low birth rates do pose a concern, but Elfers has talked up her company's success with core millennial customers. And there should be room for some continued market share gains from Justice, Gymboree, department stores like Kohl's (KSS) and JC Penney (JCP), and potentially even Walmart (WMT). (Target's (TGT) Cat & Jack line could provide some pressure.)

All told, The Children's Place looks solidly positioned. The numbers are moving in the right direction. Low price points and the need to source overseas provide some protection against the smaller, private competition hitting so many large consumer companies of late. Mall exposure is a risk, but growing digital penetration and a store closure plan (more on that later) should minimize that impact. It's a well-run business with a good brand serving a decent, if not spectacular, end market. Comps are solid, earnings are growing - and more help is on the way.

The 2020 Target

All told, I think PLCE deserves some trust from investors, the same is true when it comes to the company's reaffirmed targets for FY2020. Obviously, if an investor doesn't trust that Q1 truly was a weather issue, it's tough to trust the company's forecasting 7-plus quarters from now. But if Q1 was a blip, the path to $12 in EPS and 12% operating margins really isn't as audacious as it sounds against guidance for FY18 EPS around $8 with margins in the mid-8% range.

That's particularly true because most of the expansion is coming rather easily. Again, PLCE is spending up on SG&A this year - with an incremental $30 million budgeted for FY18. That figure drops to $15 million next year, and just $5 million in FY20. On the call, Elfers detailed a number of initiatives planned for that period, ranging from a new content management system to mobile improvements to an improved loyalty system coming in Q3.

PLCE is also closing a ton of stores - an estimated 300 in total, with ~130 coming between FY18 and FY20 (including 12 closed in Q1). That effort already has boosted margins by about 100 bps, per the call, and given recapture rates PLCE expects another 100 bps over the next two-plus years.

Against projected net sales of $2.1 billion in FY20, the diminishing incremental spend on transformation initiatives should provide 120 bps of margin improvements. Store closures add another 100 bps. That's two-thirds, or close to it, of the margin expansion being targeted here.

That's an important point. Over the past few years, a myriad retailers have set out long-term targets of their own - and most have missed, for a number of reasons. The shift to e-commerce generally is margin-dilutive overall. In many cases, weak comps across the board (particularly for mall-heavy retailers) have led to SG&A deleverage which has offset cost savings efforts. And going back to 2014-2015, in particular, many of these multi-year plans were based on some version of "we're going to do what we've been doing, only better". (Vera Bradley (VRA) is a perfect example; Pier 1 Imports (PIR) another, though its strategy seemed more plausible.)

In contrast, this is a real plan, with concrete and easily achievable goals (at least for ~two-thirds of the EBIT margin expansion). PLCE has a highly flexible lease base, with an average term of 2.5 years. It can close underperforming stores - or receive rent reductions to make those stores viable (as is already happening). It's already out in front on digital, with penetration at 26% and targeted at 35% in FY20 (in part because of those brick-and-mortar store closures).

There's more good news on the revenue front as well. International distribution points are going to rise 150% simply from a recent partnership in China, which is expected to generate $125-$150 million in new revenue by year five (an incremental 6-8% in sales). And the growing wholesale business should benefit from the partnership with Amazon.com (AMZN), including participation in the launch of Amazon Prime Wardrobe.

That's not to say the plan is guaranteed to work. Elfers emphasized on the call that the company wasn't as mall-heavy as some observers believed, given outlet and digital sales, and between digital growth and store closures its reliance on that struggling channel will only diminish (to a targeted ~30% by FY20). But mall exposure still looks dangerous from here, and like nearly all of its peers PLCE still is dealing with declining traffic.

The CEO also addressed the company's quickly growing private label credit card penetration, which she said was "not some short-term play to drive results". (This appears to be a response to a Bank of America (BAC) report that cut PLCE to "Underperform", due in part to the card, by the analyst's estimate, driving 140% of revenue growth and as much as 45% of the increase in operating income last year.) But PLCE has had a huge acceleration in penetration, and as that growth slows, there's the risk that comps will follow.

Store closures might seem bearish - it's not good news to close stores - but it's not as if those stores are disaster areas. The 119 stores left currently are running comps in the negative low single digits, per the Q1 call - and that's the bottom decile of the business, with benefits to the digital businesses and other stores from their closures. And it does appear that PLCE overexpanded in the past (that was one of the activists' criticisms back in 2014), meaning a more rationalized footprint isn't necessarily a bad thing.

The broad point overall, to emphasize, is that this is a real plan. It's a logical plan (and that honestly has not always been the case in retail the past few years). All of the efforts may not work. Mid-single-digit comp expectations for both FY19 and FY20, even with store closure help (as some of the lost sales are redirected to existing stores), are awfully aggressive for any retailer these days. Online sales are supposed to be accretive to overall margins - but the aggressive free shipping policy may limit or even reverse some of those benefits. BofA could have a point on credit card penetration.

But what makes PLCE attractive at $130 is that it doesn't need everything to work to drive solid upside through FY20 - and beyond. There's 200+ bps in margin expansion coming from store closures and pulling back on incremental SG&A. That alone gets pretty close to supporting the current price.

Valuation

Even if PLCE doesn't hit its targets, I'm not sure there's a ton of downside here. Even assuming zero organic profit growth in FY21 - just the $5 million in incremental 2020 SG&A coming off the books - EPS should get near $12 or so that year from EBIT margin expansion and buybacks, presumably with some offset from a slightly higher tax rate relatively to FY18. Even a ~zero-growth 12x forward multiple values the stock at $148 in two years, or $122 discounted back at 10%.

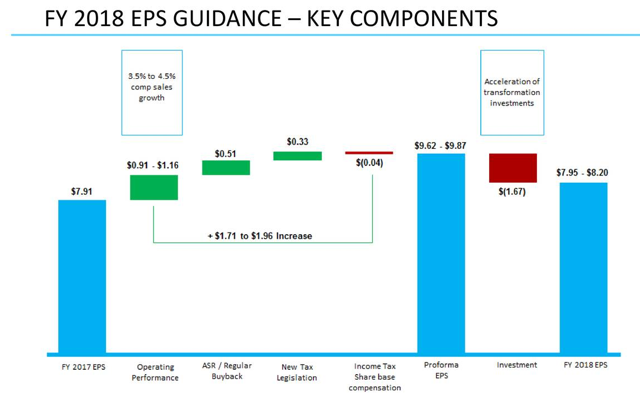

Put another way, PLCE already is trading at a basically no-growth valuation. As the Q1 presentation pointed out, EPS before the incremental SG&A spend is guided to $9.62-$9.87:

source: PLCE Q1 presentation

Even at the low end of that range, PLCE is trading at about 14x EPS. If net income simply holds steady (no help from closures, no growth in the business), and even if those SG&A initiatives have zero ROI, FY21 EPS still is easily in the double digits (likely $11+) thanks to a lower share count. With a 1.6% dividend yield, and a 12-13x out-year multiple, total returns over that period would be in the 4% range annually - hardly torrid, but not bad considering that the scenario suggests rather disappointing underlying performance.

Meanwhile, if PLCE hits its targets, there's the potential for huge upside. Reasonable assumptions suggest an enormous bounce. CRI currently trades at a bit over 18x the midpoint of FY18 guidance, and 10x+ implied EBITDA. At $12, PLCE would get to $220 by 2020 at an 18x P/E. Assuming the 12% operating margin and ~$2.1 billion in revenue, EBITDA would clear $300 million - which at 10x similarly gets the stock over $200.

The argument isn't necessarily "heads I win a lot, tails I don't lose much (or maybe win a little)," because I don't think that argument exists in retail at the moment. (I'd also point out, as I have elsewhere, that often forgotten in the debates about Amazon, e-commerce, and the collapse of the mall, is that retail is a cyclical business and we're in year nine of an economic expansion.) But right now, PLCE trades at just over 15x the midpoint of FY18 EPS guidance (backing out a couple bucks per share in net cash) just above $8. There's $1.67 - about 20% growth - coming from the $25 million in incremental SG&A spend this year coming off the books. There's ~$16 million in net income - about $1 per share - if store closures add 100 bps of EBIT margin expansion on a ~$2 billion revenue base (~5% below the current FY20 target).

Pro forma EPS for FY18 is over $10, even assuming a tax rate that normalizes from a guided ~16%-17% this year. That doesn't even include another buck or two per share coming from the $500 million in buybacks (though if they are executed in the next three years as planned, it looks like PLCE would have to raise some debt and thus pay some interest; capex is spiking over these three years as well). PLCE is trading at about 12x that pro forma EPS.

Even in retail, that's a cheap number (though pro forma EV/EBITDA is a still-healthy ~7x+). And so any downside in PLCE - and any win for the traders still shorting almost 18% of the float - requires that the business actually turn downward from an organic standpoint.

It's possible. Again, this is retail. A lighter tailwind from credit card signups could hurt. PLCE will lap the benefit of the Gymboree bankruptcy this year, and Elfers said on the Q1 call that the closures of Babies "R" Us would have a much smaller impact. More digital revenue could hurt margins; so could an Amazon partnership. Any macro stumble could add to the pressure from declining mall traffic.

But this also is a company that's been one of the best retailers in the country over the past few years. Comps grew 4.9% in FY16 and 5.8% in FY17. PLCE has a solid niche and a committed customer base. Competitors have fallen by the wayside. Undercutting the company on pricing is pretty tough, given an assortment that is heavily priced under $10, and that low pricing point and the need to replace children's clothing mitigates cyclical risk. (Comps actually rose nearly 5% in FY08 before dropping 2%+ the next three years - but as noted, there were some execution issues in there as well. Carter's grew revenue nicely right through the recession.)

PLCE already is seeing a good deal of success in omnichannel. It's investing $50 million over the next three years in SG&A, and another ~$100 million in additional capex. Even some level of ROI from those initiatives could offset organic weakness, should it come. Post-FY20, there's still some help from lower SG&A and high-margin revenue in China, along with other potential international opportunities.

When I last covered PLCE in January, at $148, I wrote that the stock looked like an argument over the future of retail. The question at those levels looked to be: can a brick-and-mortar retailer reinvent itself as an online leader without seeing margins compress substantially, and while continuing to drive positive comps?

The question now is: is PLCE on the verge of a significant organic decline? Q2 results are the biggest risk here, because they would undercut the 'weather' narrative coming out of Q1 and perhaps support fears about the fading Gymboree tailwind and/or the reliance on the credit card business.

But again, I'm willing to trust management. More importantly, the benefits simply from store closures and the tapering of investments suggest the stock should provide positive returns even if underlying performance weakens noticeably. Even if comps flatten, there's still enough between buybacks and ongoing lease flexibility to keep pro forma profit pretty much stable - and that's enough to keep PLCE at current levels, if not modestly higher.

Unless an investor sees something in Q1 that suggests that performance already is turning south - and I'm inclined to believe management's explanations for the quarter - then PLCE is too cheap at $130. And there's a reasonable path to something like 20-25% returns, including dividends, over the next two years if the underlying business just stays steady. Store closures and lower SG&A alone gets EPS near $11, and a modest 13-15x multiple gets the stock back toward $155. If management is right - and they've been right for most of the past eight years - something closer to 60-80% returns are on the table. Even for a retail bear, that looks like a bet worth taking.

Disclosure: I am/we are long PLCE.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

from Seeking Alpha Editors' Picks stocks https://ift.tt/2a97jA2

via IFTTT