Investment Thesis

On its own, Optical Cable Corporation, a manufacturer of data communication cabling and connectivity products, is a fine -- some might say boring -- investment. Knowing Ted Weschler bought more than 5% of the stock, it becomes somewhat fascinating.

Stock Purchases

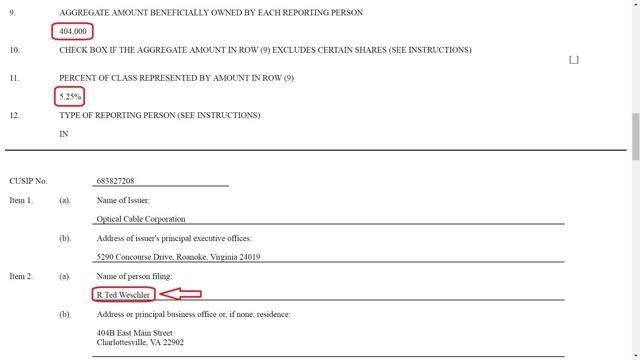

On September 24, 2018, Ted Weschler filed a 13G indicating he had accumulated a position over 5% (it was 5.25%) in Optical Cable Corporation (aka "OCC", letters that also represent the NASDAQ NMS stock symbol).

Often, in these circumstances, a buyer will file a 13D. But the SEC permits a 13G filing if the investment is passive. A 13G is appealing due to relatively lenient filing requirements. (For instance, if one files a 13D, then every "material" purchase or sale must be followed by an SEC filing within two business days. Not so with a 13G.) Since he filed a 13G, Ted Weschler must "file an annual amendment to the 13G if there have been any changes - immaterial or material - to your filed 13G ... within 45 days of year end" or "must amend their Schedule 13G within 10 days after the end of the first time their "beneficial ownership" exceeds 10% of the class of equity securities at month end".

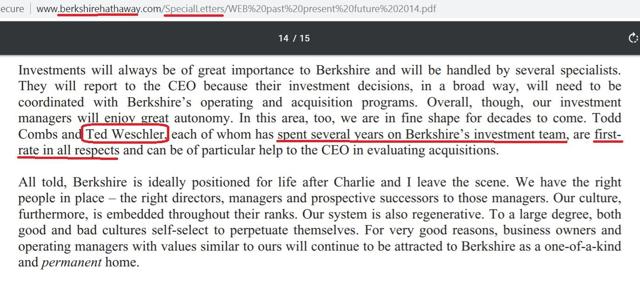

Warren Buffett, in his special letter to Berkshire Hathaway stockholders titled "Berkshire -- Past, Present and Future", expressed great confidence in Ted Weschler, calling him "first rate in all respects":

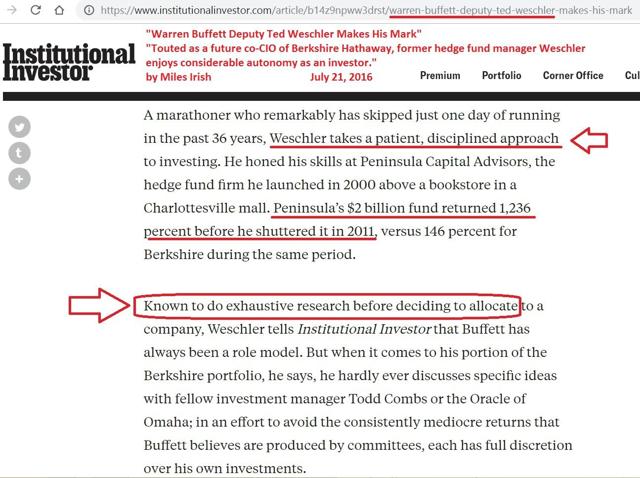

Institutional Investor profiled Ted Weschler in 2016, saying he is "known to do exhaustive research before deciding to allocate to a company."

Looking at a price chart of OCC stock, it seems that the average price for Ted Weschler's purchase of 404,000 shares was likely around $3.75 per share, suggesting Weschler paid $1.5MM for his OCC shares. A fair question: how important is that compared to Weschler's net worth? DealBook reported: "Here is a quick measure of his wealth: he paid $2,626,311 in a charity auction to have lunch with Mr. Buffett in 2010. That’s how they met. A year later, Mr. Weschler paid $2,626,411 to dine with him again."

Note the high volume -- 667,600 shares in aggregate -- between September 14, 2018, the date on which the 5% threshold was exceeded, triggering the requirement to file a 13G, and the filing itself, which was made, as permitted, after the close ten days later on September 24.

In the ten-day window between triggering the requirement to file the 13G and the filing itself, average daily trading volume was 95,731. That ten-day average trading volume represented a 5.8 multiple of year-to-date (through September 14) average trading volume earlier in 2018. Was Weschler continuing to buy during the ten-day window before the 13G was filed?

In the ten-day window between triggering the requirement to file the 13G and the filing itself, average daily trading volume was 95,731. That ten-day average trading volume represented a 5.8 multiple of year-to-date (through September 14) average trading volume earlier in 2018. Was Weschler continuing to buy during the ten-day window before the 13G was filed?

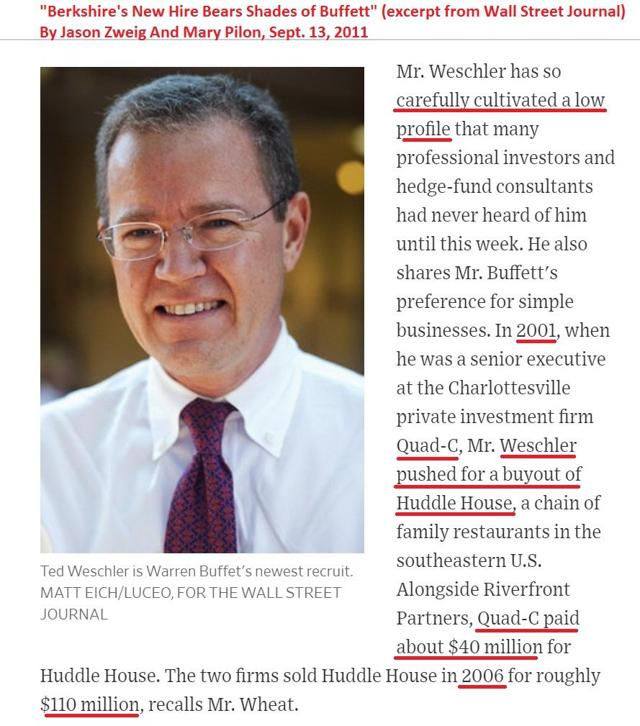

Weschler is typically a passive investor, as confirmed in this case by the 13G filing for OCC. But a 2011 Wall Street Journal story "Berkshire's New Hire Bears Shades of Buffett", Jason Zweig and Mary Pilon recounted how, in 2001, Weschler "pushed for a buyout of Huddle House, a chain of family restaurants". Could Weschler convert his 13G filing to a 13D filing and push for a sale? Sure; that would be legal. Would he?

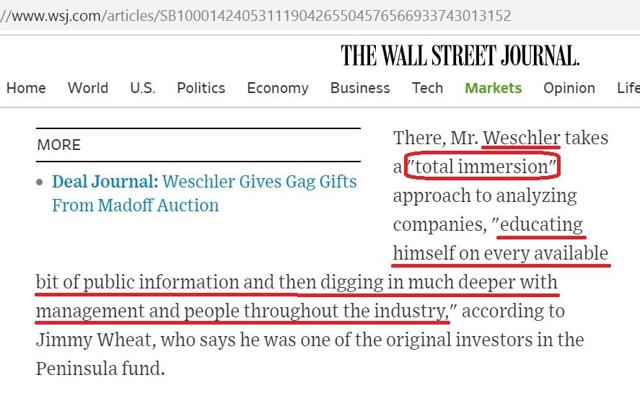

The same WSJ article affirms Weschler's analytical approach, described as "total immersion".

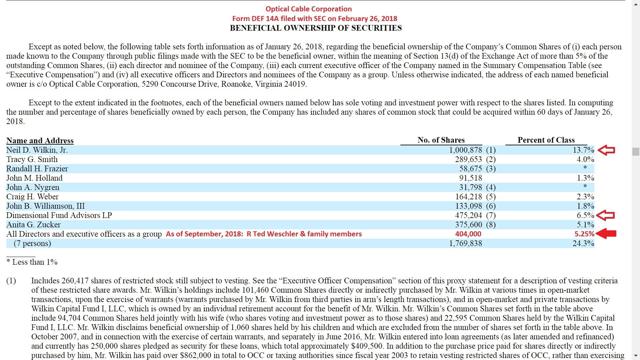

The same WSJ article affirms Weschler's analytical approach, described as "total immersion". Weschler's reported 5.25% ownership (which does not reflect further purchases after September 14, if any) is meaningful compared to other large holders.

Weschler's reported 5.25% ownership (which does not reflect further purchases after September 14, if any) is meaningful compared to other large holders.

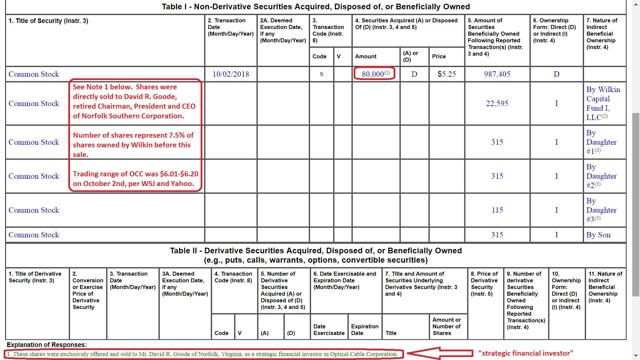

Insider sales

On October 4, 2018, ten days after Weschler's 13G filing, OCC's Chairman of the Board, President and Chief Executive Officer Neil Wilkin filed a Form 4 with the SEC, indicating he had sold 80,000 shares of OCC at $5.25 per share, marking his largest sale in the SEC's electronic filings era. While not necessarily bad, an insider sale is typically not a good sign.

This was odd.

The sale price was reported to be $5.25, but the range that day was $6.01-$6.20.

Furthermore, the sale was to David R. Goode, described as a "strategic financial investor". Please refer to the tiny green print below, which says: "These shares were exclusively offered and sold to Mr. David R. Goode of Norfolk, Virginia, as a strategic financial investor in Optical Cable Corporation."

Who is David R. Goode?

David Goode is the retired president, ceo and chairman of Norfolk Southern Corporation. He serves on the board of directors of Russell Reynolds Associates. David Goode has served on the boards of directors of Caterpillar, Inc., Delta Airlines, Inc., Texas Instruments and Georgia Pacific.

In 2005, Norfolk Southern named its 12 story building at 1200 Peachtree Street in Atlanta the David R. Goode Building, in honor of the company's chairman and chief executive officer. (See photo below.)

Is $420,000 investment in OCC a full position for a man like David R. Goode? Is David Goode being recruited for a role at OCC?

Separately, yet another insider sale may not be what it seems.

On October 15, 2018, Director Randall Frazier sold 4,534 shares to "a trust for the benefit of a long-term individual investor", at $5.30, a price above the day's range of $4.96-$5.27. Again, that is an insider sale that may not have the meaning of many typical insider sales. Who is the long-term investor?

Coming days after Ted Weschler's 13G filing, are the Goode and Frazier transactions good or bad signs? Is the Goode purchase a defense against Weschler, who filed a non-activist form 13G? Or is the Goode purchase affirmation that something good is happening at OCC? Time will tell.

Could OCC be acquired?

Yes. While that scenario is not my base case, it is instructive to note that the industry has been consolidating.

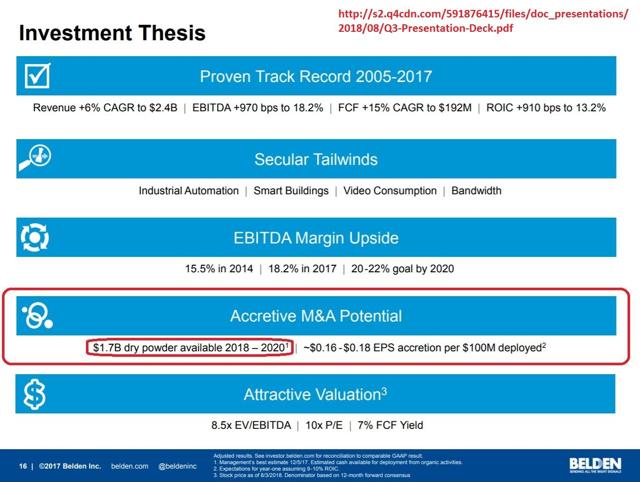

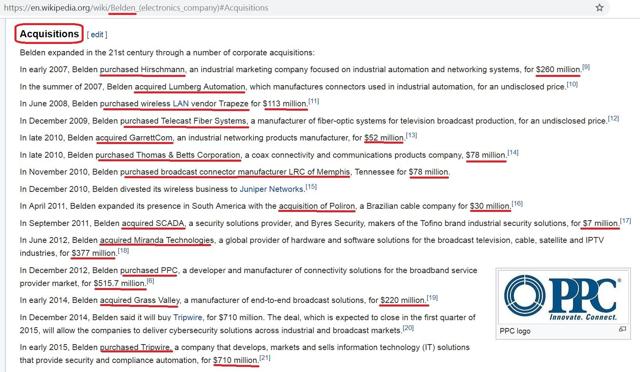

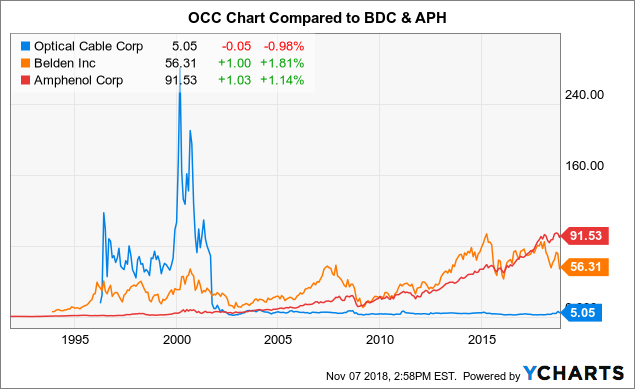

Belden, a company identified as a competitor in OCC's 2017 10-K, made 13 acquisitions in an eight year period for amounts between $7MM - $710MM.

Going forward, Belden has planned to allocate up to $1.7B to fund acquisitions during 2018-2020.

Going forward, Belden has planned to allocate up to $1.7B to fund acquisitions during 2018-2020.

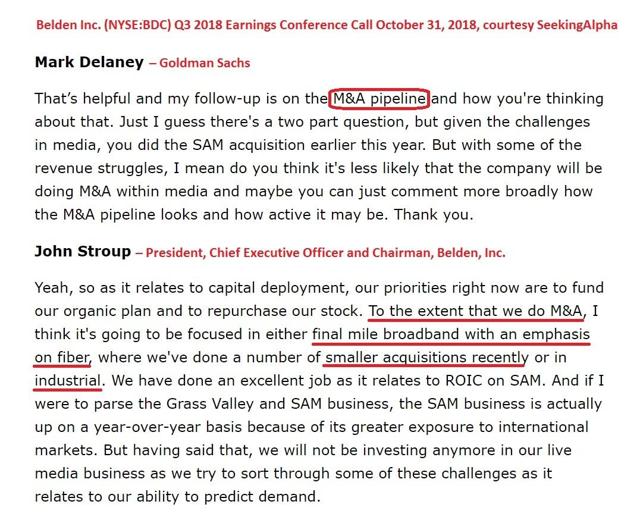

On the 2018 Q3 earnings conference call, Belden parsed its acquisition strategy by saying that M&A will focus on the industrial segment and smaller acquisitions in the fiber optic segment, two areas to which OCC has exposure.

Other companies are focused on acquisitions as well, as the industry consolidates.

In a deal stuck last December, Prysmian SpA paid 13.5 times trailing EBITDA for OCC-competitor General Cable, accounting for debt. Bloomberg reports that "Four groups were involved in bidding, including a Chinese company, pushing up the price." (For OCC, a 13.5 multiple of my FY2019 projected EBITDA would come to over $10/share, after accounting for debt.) Bidding for General Cable was competitive. Again, an acquisition is not my base case.

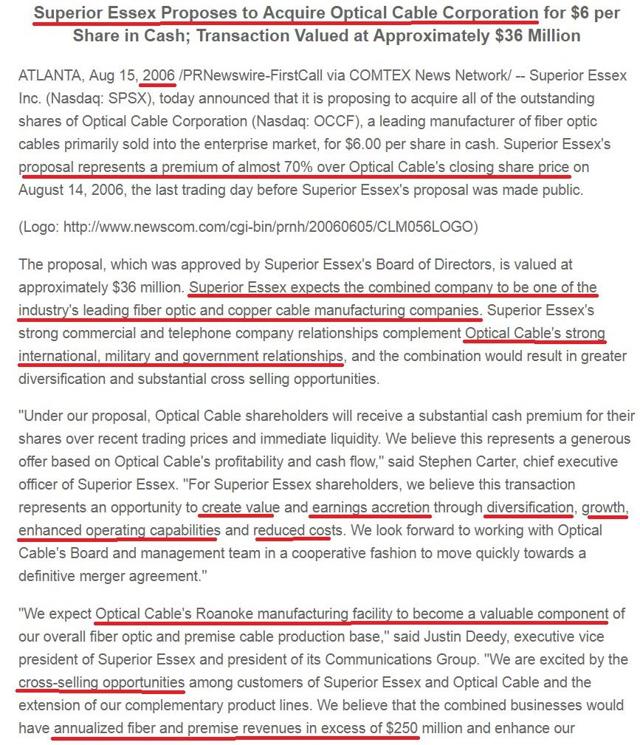

As a small player in the industry, OCC may not attract as much interest. But note that, in 2006, Superior Essex Inc. offered to acquire OCC for $6/share. OCC rejected the offer. Superior Essex in turn was acquired two years later.

If OCC were to be acquired, I would expect Chairman of the Board, President and Chief Executive Officer Wilkin would either: 1) be severed with a big pay package; or, 2) be given much larger role at the acquiring company. Given Wilkin's total compensation in FY2017 of $780,469 when the company recorded a net loss, and given Wilkin's obvious talents (see degrees from both University of Virginia's Darden School of Business and School of Law), an acquiring company could benefit from promoting Wilkins.

If OCC were to be acquired, I would expect Chairman of the Board, President and Chief Executive Officer Wilkin would either: 1) be severed with a big pay package; or, 2) be given much larger role at the acquiring company. Given Wilkin's total compensation in FY2017 of $780,469 when the company recorded a net loss, and given Wilkin's obvious talents (see degrees from both University of Virginia's Darden School of Business and School of Law), an acquiring company could benefit from promoting Wilkins.

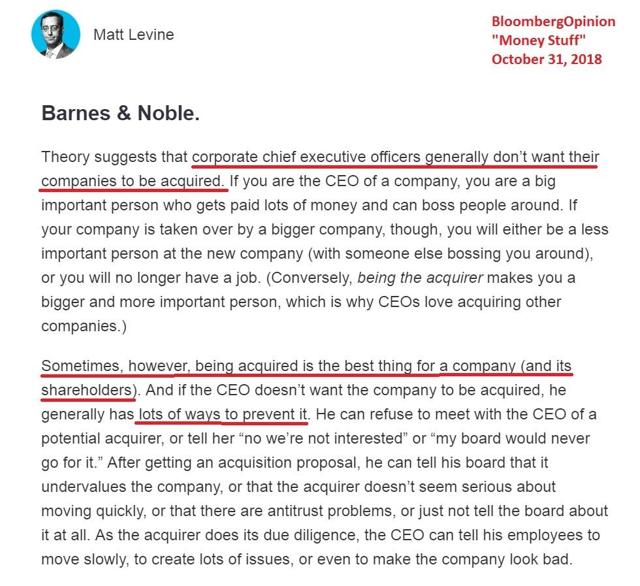

As Bloomberg columnist Matt Levine writes below "Sometimes, however, being acquired is the best thing for a company (and its shareholders). And if the CEO doesn’t want the company to be acquired, he generally has lots of ways to prevent it." I have no opinion as to whether Matt Levine's NYC-lawyer cynicism (which I like) applies in this case. Does the introduction of an investor with the gravitas of Ted Weschler change the calculus regarding an acquisition? If Warren Buffett's guy supports an acquisition, could OCC's board possibly resist?

Note that OCC itself made two acquisitions a decade ago: SMP Data Communications in 2008 and Applied Optical Systems in 2009.

Note that OCC itself made two acquisitions a decade ago: SMP Data Communications in 2008 and Applied Optical Systems in 2009.

OCC's Industry

OCC manufactures fiber optic and copper data communication cabling and connectivity solutions for the enterprise market, various harsh environment and specialty markets, and the wireless carrier market. OCC’s product offerings include designs for uses ranging from enterprise networks, datacenters, residential and campus installations to customized products for specialty applications and harsh environments, including military, industrial, mining, petrochemical, wireless carrier and broadcast applications.

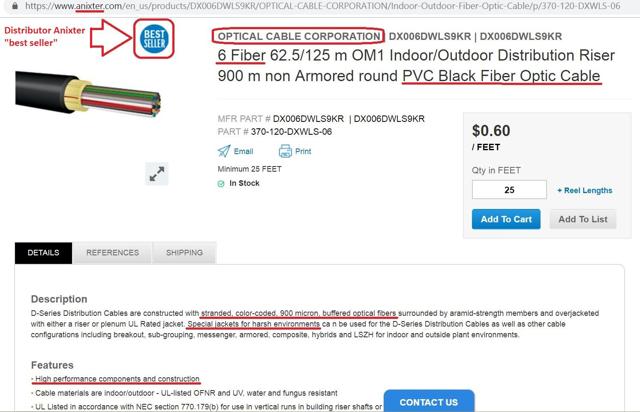

Anixter, a global distributor, highlights this PVC fiber optic cable below as the only designated OCC "best seller" that Anixter distributes:

At its Annual Meeting of Shareholders held in March, 2018, OCC featured the following video regarding Passive Optical LAN as an example one of its product initiatives:

Financial projections

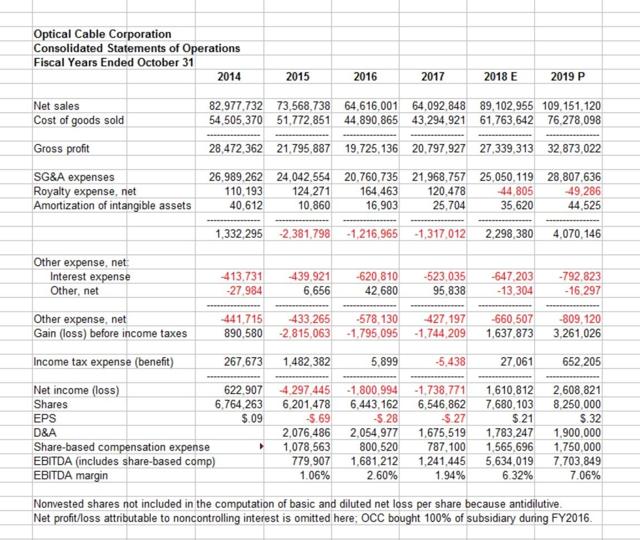

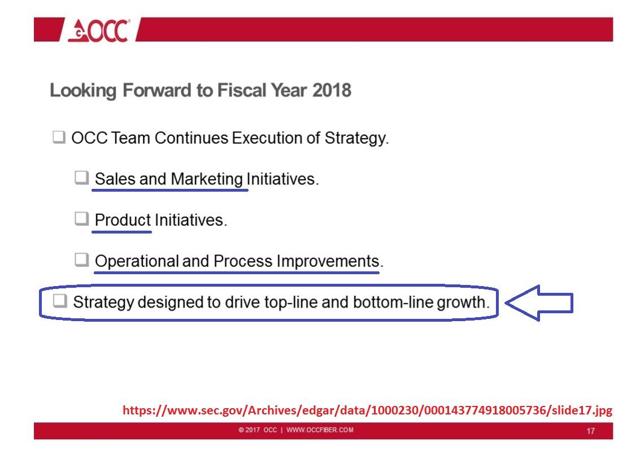

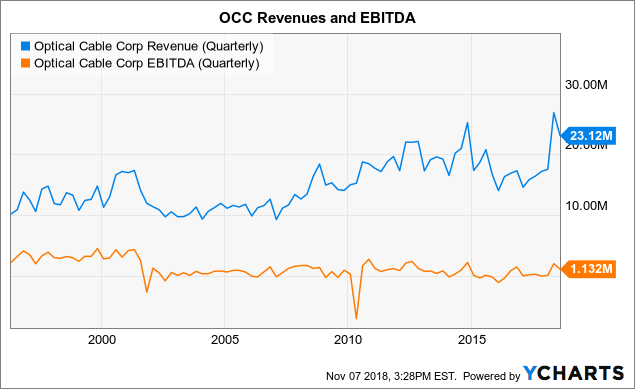

Building off OCC's past financials, including strong results driven by defense and wireless sectors in FY2018 (ended October 31), moderated by winding down of material contract(s) in FY2018, and informed by management goals expressed in the 2018 Annual Meeting, along with insights from competitors (largely Belden and Amphenol), I have projected OCC's income statement for FY2019. Note that, since OCC management was unresponsive to repeated inquires via phone calls and emails, as is any company's right so long as it doesn't violate the SEC's Reg FD, the estimate for FY2018 and the projection for FY2019 should be considered a best guess at this time, decidedly not a rigorous model developed after detailed questions answered by management. (Note: As I continue research coverage OCC in the future, I continue to welcome a dialogue with management. I would like to understand more fully management's side of the story, if they cared to share.) Note that FY2019 results are expected to be back-end loaded.

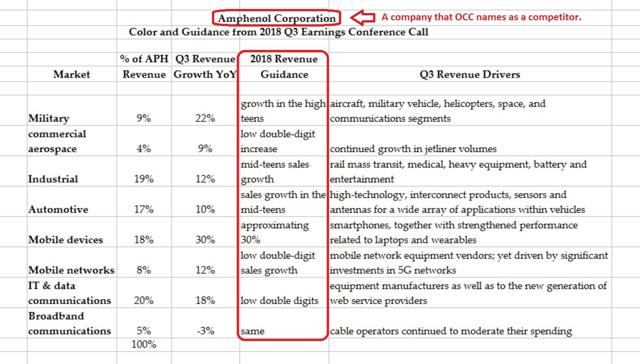

In management's defense, given a base of OCC's FY2018 Q3 revenue of $23MM compared to an industry dominated by competitors such as Amphenol with 2018 Q3 revenues of $2.1B, a small change in the timing of fulfillment of a minor order (by industry standards) can make a huge difference in OCC's results. Lumpy is difficult to forecast.

In management's defense, given a base of OCC's FY2018 Q3 revenue of $23MM compared to an industry dominated by competitors such as Amphenol with 2018 Q3 revenues of $2.1B, a small change in the timing of fulfillment of a minor order (by industry standards) can make a huge difference in OCC's results. Lumpy is difficult to forecast.

For FY2019 (ended October 31), my OCC revenue projection shows an increase of 22.4% year over year, down from 39.0% estimated increase for FY2018 YoY. Driven by operating leverage, OCC's EBITDA margins are projected to increase from 6.3% (FY2018 E) to 7.0% (FY2019 P).

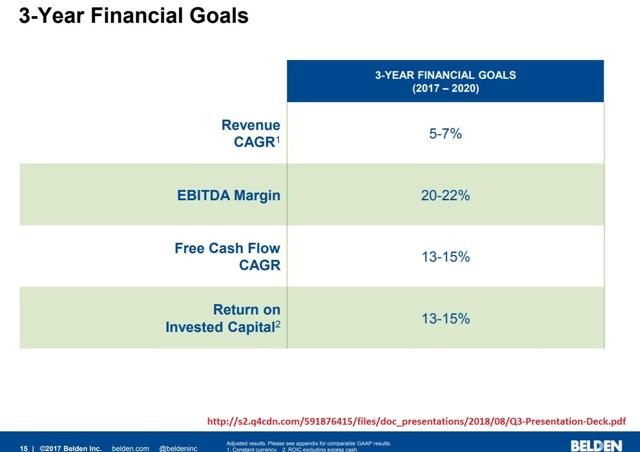

OCC competitor Belden's 3-year financial goals are below, including an EBITDA margin three times my projection for OCC's FY2019 EBITDA margin:

OCC competitor Amphenol provides a breakdown of its revenue growth by segment, as shown below. The drivers for strong revenue growth are partly segment strength and partly market share increase or decrease. The table below is tabulated from Amphenol's Q3 conference call:

Amphenol guided to aggregate 12% organic revenue growth for 2018. Focusing on OCC's strong segments, Amphenol is guiding "high teens" in APH's military segment and "low double digit sales growth" in APH's mobile networks segment. Including stock-based compensation expense (to make it an apples-to-apples comparison with my OCC EBITDA calculation), APH's EBITDA margin for the nine months through September 30, 2018 was 24.5%.

Amphenol guided to aggregate 12% organic revenue growth for 2018. Focusing on OCC's strong segments, Amphenol is guiding "high teens" in APH's military segment and "low double digit sales growth" in APH's mobile networks segment. Including stock-based compensation expense (to make it an apples-to-apples comparison with my OCC EBITDA calculation), APH's EBITDA margin for the nine months through September 30, 2018 was 24.5%.

Contrast that to OCC's estimated FY2018 EBITDA margin is 6.3%. There could be room to grow!

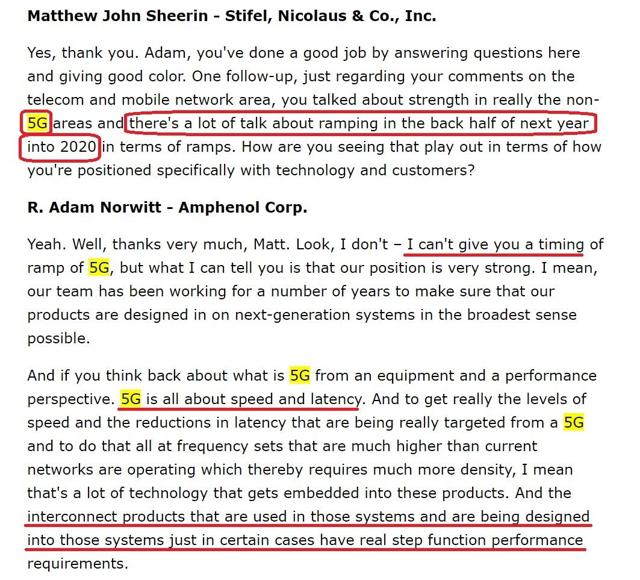

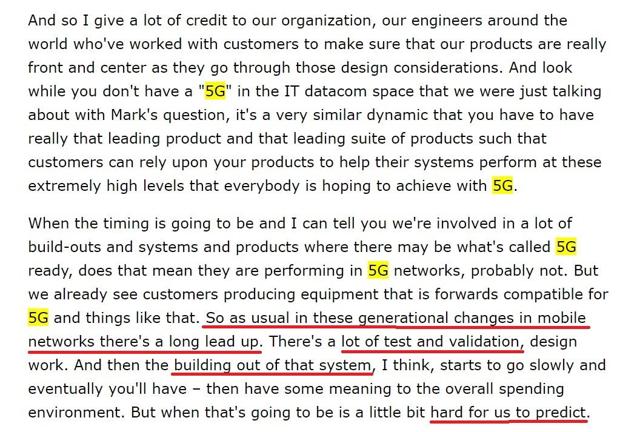

OCC could surprise on the upside. For example, 5G is an exciting technology that, if it fulfills expectations, could help to drive sales growth in OCC's wireless carrier market. But, as transcribed by SeekingAlpha, on APH's Q3 earnings conference call, Amphenol's President and CEO Norwitt was cagey regarding 5G:

OCC has a fair amount of operating leverage. As the company states in its FY2018 Q3 10-Q: "Our gross profit margin percentages are heavily dependent upon product mix on a quarterly basis. Gross profit margin in the first nine months of fiscal year 2018 was negatively impacted by a shift in product mix toward the sale of certain lower margin products in the first nine months of fiscal year 2018 compared to the first nine months of fiscal year 2017. However, the significant increase in net sales levels during the first nine months of fiscal year 2018 for our fiber optic cable products helped to offset the impact of the decrease in gross profit margin on gross profit, as certain fixed manufacturing costs were spread over higher sales and we benefited from our operating leverage."You can see from the projected income statement below that EBITDA margins jumped from 1.94% in FY2017 to 6.32% in FY2018 (estimated) even though gross margin dropped from 32.45% in FY2017 to 30.68% in FY2018 (estimated). Two reasonable comparable companies are Belden and Amphenol. Both those companies enjoy EBITDA margins that are at least triple OCC's EBITDA margins. That suggests OCC's EBITDA margin will have room to improve if they continue to boost revenues, as I expect. That is the base case.

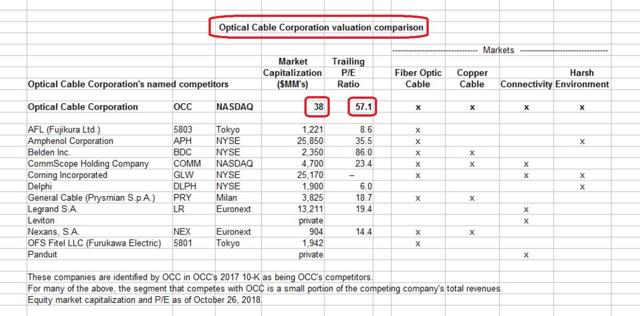

Valuation

Based on trailing P/E ratio, as shown below, OCC is expensive. Based on projected FY2019 EPS, at $5.10 per share (the close on November 8th, hours after which this piece was resubmitted), OCC's projected FY2019 P/E is a more reasonable 16.5.

Regarding potential price targets for OCC stock, a rounded number of $10 seems reasonable couple years from now. While I have not shown projections for FY2021, if we think of valuing OCC stock two years from now, twenty times $0.50 FY2021 EPS seems reasonable.

And, $10 as an acquisition price a year from now also seems reasonable, using Prysmian SpA's acquisition's trailing EBITDA multiple of 13.5 on $7.0MM of OCC's FY2019 EBITDA (after normalizing OCC's non-cash compensation to industry norms), and subtracting anticipated debt of $12.5MM, using 8.25MM shares as the divisor. A multiple of 13.5 times might seem high, but typically a small company target lends itself to synergies through economies of scale. An acquisition of OCC could produce synergies in a number of ways, including: 1) boosting sales by adding channels while at the same time improving efficiencies; 2) boosting capacity utilization at OCC's three plants, which would increase margins; and, 3) spreading out other SG&A expenses over greater sales. For example, as noted above, OCC Chairman, President and CEO Wilkin is a very talented guy; by elevating him to a bigger management position at a bigger company, his (rather large in my opinion for a small company, but not large for his talents) compensation could be spread over greater sales, benefiting margins not only at the legacy OCC business but also the larger portfolio he could manage.

On the downside, I would expect that, so long as Weschler is not selling, $3.50 - $4.00 would be a floor if OCC encounters temporary disappointment.

The favorable backdrop is: 1) solid demand for data communications including potential excitement regarding the roll-out of 5G; and, 2) Weschler's ownership.

What could go wrong with the investment thesis?

Following Weschler's 13G requirement trigger on September 14, but before the filing itself on September 24, volume was high, equaling 5.8X volume earlier in 2018. Who was buying? My guess: Weschler continued to buy, knowing the 13G disclosure would send OCC's share price higher, forcing him to pay more (if he wanted to buy more). Indeed, volume spiked following the filing. But, what if Weschler had changed his mind and the high volume in late September or in October was Weschler selling? I doubt it. But that would be a big problem for the investment thesis!!!

While acquisitions are not my base case, an acquisition does represent upside. On the other hand, OCC could receive but reject a takeover offer that many stockholders might want. But the addition of Weschler to the mix might introduce more analytical, data driven response to a takeover suitor, boosting the prospects for a completed acquisition On the other hand, OCC might eagerly search out acquisitions of its own, potentially reducing its appeal to potential acquirers.

The competitive landscape could change. Big competitors might swamp OCC.

A word of caution: the equity market capitalization of OCC is tiny: $40MM. Average trading volume for the past 65 days is 41,896 shares. Patience and limit orders are advisable if buying or selling OCC stock.

OCC data by YCharts

OCC data by YCharts OCC Revenue (Quarterly) data by YCharts

OCC Revenue (Quarterly) data by YChartsAppendix 1 -- Executive Officers

If you don't like the chairman and the ceo to be one and the same, you might not like the organizational structure of OCC. (Studies are mixed.)

If you don't like the only two executive officers being the former cfo and the current cfo, you might not like the organizational structure of OCC.

Chairman of the Board of Directors, President and Chief Executive Officer Wilkin was named CFO in September, 2001. Chief Financial Officer Smith was named CFO in September, 2003. Both Wilkin and Smith were practicing CPAs employed by Coopers & Lybrand (a predecessor to PricewaterhouseCoopers) and KMPG LLP, respectively.

From 2011 to 2018, proxies for every OCC annual meeting held have identical language: "The current executive officers of the Company are: Neil D. Wilkin, Jr., Chairman of the Board, President and Chief Executive Officer and Tracy G. Smith, Senior Vice President and Chief Financial Officer."

The most recent executive officer directly responsible for marketing and/or sales, Senior Vice President of Sales--USA William R. Reynolds, retired on December 17, 2010.

You might want to see a Senior Vice President of Sales in an executive officer position. So would I. If done correctly, elevating sales and marketing to an executive officer position, or even a board position, could enhance results.

Does the lack of response to my questions by Wilkin, Smith and OCC's investor relations provide insight into OCC's sales and marketing culture, or lack of one? There is little published investment research on OCC. (For example, Seeking Alpha has published two pieces, one in 2017 and one in 2012.) With so little research available, how does one explain management's apparent disinterest in offering to help shape a narrative to be published for an audience of investors? (OK, this author is not a big deal compared to Weschler and Goode! Point well taken!) The SEC's Reg FD might come into play; Wilkin is well versed in the law. Or perhaps OCC is in a quiet period, during which no conversations with investors are allowed. A disinterest in helping to shape a narrative might suggest a deficient sales and marketing culture, or it might suggest something different. Hard to say. Easy to fix.

Disclosure: I am/we are long OCC.

Additional disclosure: In addition to Seeking Alpha's Terms of Use: Read this article at your own risk. Under no circumstances should this article be construed to be investment advice. You agree to do your own research and your own due diligence. Always consult a financial advisor. In no event should Great Quarter be liable for any losses. I make mistakes and I've been wrong many times. While, to the best of Great Quarter's ability and belief, great care was put into its research, analysis, opinion, and writing, and while this article and the information herein is believed to be accurate and reliable and does not omit material facts, it is presented “as is” and without representations or warranties of any kind, express or implied. Great Quarter makes no promise to update articles or any information, analysis, or opinion herein. Following the publication of this article, Great Quarter reserves the right to make any trade at any time in any securities mentioned; in the future, I may be long, short, or neutral regardless of any information, analysis, or opinion herein; furthermore I will not report when a security position is initiated or exited. Humans are bad at predicting the future. Part of this article attempts to predict the future. Great Quarter's goal to be more right about the future than wrong. But, the future will hold many surprises. Please be aware that at least part of this article will prove to be wrong. Since Great Quarter is not receiving compensation for this article from Seeking Alpha, Great Quarter retains the copyright. Great Quarter welcomes readers to comment or ask questions in the comment section below. If you enjoyed this article, please follow Great Quarter by clicking Follow above.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

from Seeking Alpha Editors' Picks stocks https://ift.tt/2a97jA2

via IFTTT