(The following is excerpted, with modification from Dane Capital's 1st quarter investor letter)

We own several small-cap, low-multiple stocks that trade modest, often, almost insignificant volumes such as Infrastructure and Energy Alternatives (IEA), Lazydays (LAZY), and Limbach (LMB). We’re often asked, “Why own companies like these? They don’t trade, no one cares and they’re never going to get a multiple.”

While that opinion might be correct in the short-term, we believe that over the longer-term, if we’ve made the right stock selections, we’ll be disproportionately rewarded.

When we look at Limbach (5x EV/EBITDA), IEA (>4x EV/EBITDA), or Lazydays (5x EV/EBITDA), we think of some of the nano-caps that have made it big over the last several years. Most are not in particularly exciting businesses but have large runways for growth and the potential to be consolidators, which we believe is true of the aforementioned companies.

For example NV5 (NVEE), an E&C company that went public with a market cap below $30 million, now has the premium multiple in the sector and an enterprise value approaching $700 million. Besides Roth, who took them public, there was no following. It took about a year of waiting, and then a series of acquisitions took the stock to another level. After that, there were still days when there was no trading volume. Additional acquisitions were executed, and with these acquisitions came further price appreciation and greater trading volume. Investors have largely disregarded the fact that almost the entirety of the company’s growth has been inorganic. That the stock price increased, resulting in the inclusion in indices certainly didn’t hurt either. NV5 has enjoyed the benefits of multiple expansion on top of EBITDA growth, resulting in an explosion in its stock price (10x in 5 years).

We believe that acquisitions for companies like IEA, Lazydays, and Limbach can be transformative, and we expect they will be. Each of these companies is small enough that an acquisition can materially change the company’s growth rate.

For example, Lazydays has stated that it aims to be a $2 billion revenue company in 5 years. Given that they are currently forecast (by single analyst Craig-Hallum) to do $650 million in revenue this year, to achieve $2 billion in revenue, in addition to modest organic growth, that will require a lot of M&A, and revenue improvement at the acquired companies. It would also require a 25.2% CAGR for the next 5 years. It's hard to envision that Lazydays wouldn't see massive multiple expansion from its current 5x EV/EBITDA if it achieves its target, and there are 1000s of targets (although perhaps only several hundred relevant ones), while paying 3x EBITDA for acquisitions. We believe Lazydays stock won't be lazy, and could be a massive compounder.

Source: Lazydays Investor Presentation, page 15

The amazing thing is that even at $2 billion in revenue, the company would still have well under 10% market share. We don't expect Lazydays to remain at these prices for long. As Craig-Halllum recently wrote in its initiation report, “We see a path to $2 billion in sales, $120 million in EBITDA and a $50 stock in 5 years.”

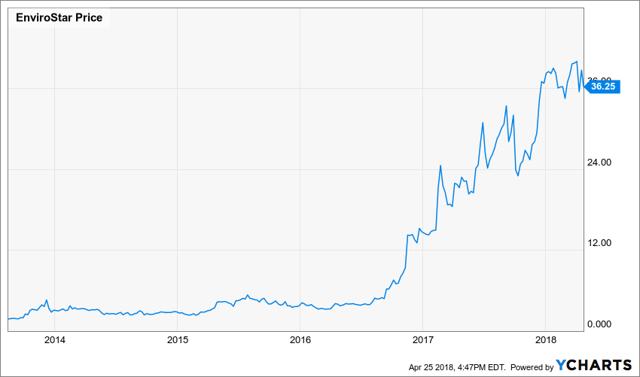

Another example of a seemingly sleepy company that saw its share price explode upon making acquisitions is Envirostar (EVI).

Envirostar is in the very sexy business of distributing commercial, industrial, and vended laundry and dry-cleaning equipment. On March 9, 2015, Henry Nahmed became Chairman and CEO of the sub-$20 million market cap company. For the first 18 months under his leadership, trading volume was modest, and the stock was mostly sideways. In September 2016, the company announced it was purchasing Western State Design, and the stock took off and never looked back. Following acquisitions in June and November 2017, the stock ascended to new heights. Today this laundry equipment distribution company commands a premium EV/EBITDA multiple, well into the double-digits. Anyone who invested when Nahmed became CEO has more than a 10-bagger in 3 years, although it took 18 months before the stock did anything, which speaks to the virtue of patience.

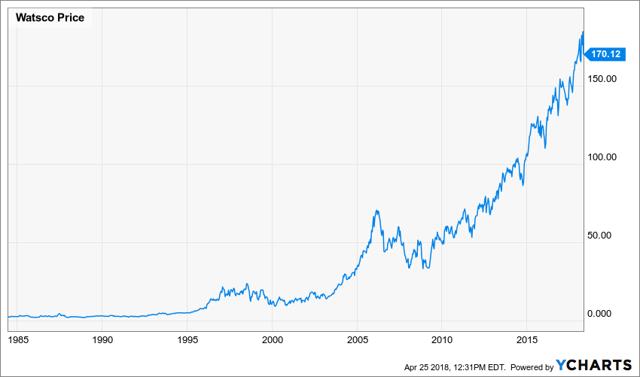

If one really wants to discuss patience, one need look no further than Henry Nahmed’s uncle, Albert Nahmed, Chairman and CEO of Watsco (WSO), a leading distributor of HVAC and refrigeration equipment – another not so exciting business.

Watsco went public in 1984 with a market cap of $15 million and more or less flat-lined for 10 years before moving aggressively into distribution through a plethora of acquisitions. Last year the company generated over $4 billion in revenue, and currently has a market cap of almost $6 billion and sports a hefty 15x forward EV/EBITDA multiple. If you bought the Watsco IPO and held, and reinvested dividends, you’d have well over a 100-bagger.

We hope not to see our investments flat-line for 10 years before getting paid. What we believe our investments have in common is that they all are wonderful platforms for growth when they find the right acquisitions, which we believe will be relatively short-term. For Limbach, it’s taken longer than we would have anticipated. Each has a runway for significant growth — growth that will exceed industry peers, and potentially take the company from being the low-multiple player to the high-multiple player in the space. We view being small and tightly held as a short-term nuisance, but potentially beneficial over time. Waiting is never fun, but we think our patience will bear fruit.

As a final note, while not quite as small or illiquid as IEA, LAZY or LMB, Daseke (DSKE) trades at just 6x EV/EBITDA having fallen precipitously since the announcement, and poor execution, of its February follow-on offering. Rarely do we see a company that is the market leader, with just 1% market share of a $133 billion market. In September 2011 Brad Jacobs took over as Chairman and CEO of XPO Logistics (XPO), at the time a $60-$70 million market cap company, with the goal of consolidating/rolling-up the logistics/asset-light business. Don Daseke has the not so different dream of consolidating the flat-bed/"asset-right" segment, In his April 2012 initiation of XPO, Stifel trucking/logistics analyst John Larkin wrote:

we must admit that when we first heard that Brad Jacobs, XPO Logistics CEO, was considering rolling up the truck brokerage space – we had our doubts. However, upon closer inspection, we have come around to thinking that Mr. Jacobs just may be on to something.

I happened to speak to Mr. Larkin about Mr. Daseke at the time of the SPAC merger and he voiced similar sentiments about Daseke's goals, but thought he was the man who could get it done.

Of course XPO is now a global leader with a $12 billion market cap. We're curious how many readers recall XPO's 64% decline between June 2015 and January 2016 - this did not occur at a bad time for the industry. Anyone who stayed the course now has a 5-bagger in just over 2 years (it hit $18.06 on January 20, 2016).

With just 1% market share, a highly motivated management team (CEO Don Daseke still owns almost 40% of the company and almost 2 years remaining on his lock-up), and sentiment about as bad as it can get, we see a lot more that can go right than can go wrong. Sentiment ought to turn - we don't know long it will take, we're investors, not traders - but we believe it will turn and that we'll be amply rewarded.

Disclaimer: This article was provided for informational purposes only. Nothing contained herein should be construed as an offer, solicitation, or recommendation to buy or sell any investment or security, or to provide you with an investment strategy, mentioned herein. Nor is this intended to be relied upon as the basis for making any purchase, sale or investment decision regarding any security. Rather, this merely expresses Dane's opinion, which is based on information obtained from sources believed to be accurate and reliable and has included references where practical and available. However, such information is presented "as is," without warrant of any kind, whether express or implied. Dane makes no representation as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use should anything be taken as a recommendation for any security, portfolio of securities, or an investment strategy that may be suitable for you.

Dane Capital Management, LLC (including its members, partners, affiliates, employees, and/or consultants) (collectively, "Dane") along with its clients and/or investors may transact in the securities covered herein and may be long, short, or neutral at any time hereafter regardless of the initial recommendation. All expressions of opinion are subject to change without notice, and Dane does not undertake to update or supplement this report or any of the information contained herein. Dane is not a broker/dealer or investment advisor registered with the SEC, Financial Industry Regulatory Authority, Inc. ("FINRA") or with any state securities regulatory authority. Before making any investment decision, you should conduct thorough personal research and due diligence, including, but not limited to, the suitability of any transaction to your risk tolerance and investment objectives and you should consult your own tax, financial and legal experts as warranted.

Disclosure: I am/we are long DSKE, IEA, LAZY, LMB.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

from Seeking Alpha Editors' Picks stocks https://ift.tt/2a97jA2

via IFTTT