Note: A version of this report was shared last week with members of Value Investor's Edge.

Seaspan Overview

Seaspan Corp. (SSW) is the world's largest containership leasing company, with a fully-delivered fleet of 112 vessels ranging between 2,500 TEU and 14,000 TEU. SSW charters their ships to multiple top-tier shipping lines, but the bulk of their long-term exposure is with Asian firms, most of which have heavy government support.

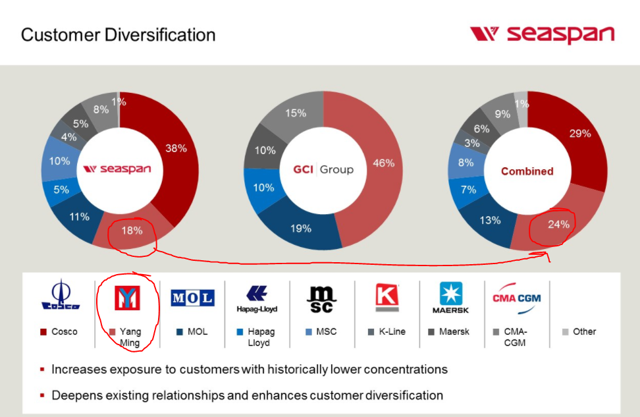

Key counterparties include China's COSCO, Taiwan's Yang Ming, European heavyweight MSC, and Japan's MOL and K-Line. SSW's closest publicly-traded comparable is Costamare (CMRE); Seaspan is larger, has more modern assets and has a much more robust charter backlog.

Seaspan currently pays a $0.125/qtr. dividend, for an effective yield of close to 7.8% in its current trading range. They used to pay out triple this amount, but in response to challenging market conditions and the bankruptcy of a medium-sized counterparty, they decided to cut the dividend and focus on the balance sheet. This focus led to hefty dilution, but they have since applied the majority of these new proceeds to a massive takeover transaction.

Seaspan's GCI Acquisition - Tone Change

Seaspan announced a major acquisition last Wednesday (14 March), adding 18 vessels, the majority with long-term charter contracts, in a transaction worth $1.6B. Although this was a fairly expected development for long-term followers of this company, the news led to a massive price jump due to a change in tone combined with the oversold nature of the stock.

SSW had been suffering from weaker market sentiment combined with a lack of investor support due to unexplained dilution. The most obvious market threat was the concern that new US tariffs could hurt global trade volumes. This combined with weak investor sentiment due to continued dilution, which appeared inexplicably rampant before the GCI deal was announced. In early-2018, SSW concluded a $250M Fairfax investment, which was poised to add over 38M shares (via $6.50 warrants) over the next few years. To make matters worse, on the recent earnings announcement, SSW announced they sold another 6.75M shares at close to $6.00/sh during November and December 2017. Ouch!

SSW's debt was high but dumping gobs of stock near all-time lows was a terrible way to address this concern. Following the GCI announcement, we know that the majority of the recent equity raises were meant for this major deal... The company is adding ships along with shares. Hooray! Bullish headlines were poised to ensue...

Valuations certainly matter for investors, but stories matter far more. Seaspan's story had previously been trashed, now they are back on a roll. This deal is helpful to valuations, but more importantly the Seaspan story has improved- and stories drive momentum especially as CEO Chen promises more transactions to come and Prem Watsa scales his commitment to $500M via two sets of Fairfax investments (second $250M will be added in January 2019).

GCI Deal Overview

Seaspan explained the deal fairly well in this attached presentation and also in a conference call last week. When I originally penned our exclusive commentary, a transcript wasn't posted; however, Seeking Alpha added one this morning. For those who prefer audio, this link will allow you to listen to the playback (quick registration might be required), 20 minutes of good Q&A.

The basics of the deal:

- 18 Vessels (204k TEU) with $1.3B in backlog

- All-in price of $1.6B, versus $2.6B valuation two years ago

- SSW Paid: $1B in debt + $140 NB, $330M cash, $50M SSW-D

- Financing: $500M from Fairfax (5.5%, then 77M shares eventually)

- $100M from Citi + $120M expected for newbuild finance

- SSW is now #1 by far, but still only has 8% of the market

The deal expands their backlog to $5.6B and adds some charter diversity. All of their charterers seem to be in good shape except for Yang Ming. The biggest downside of the deal is that Yang Ming increases to 24% of exposure.

Conference Call Q&A

I recommend listening or reading the transcript for yourself, but I've included some of the highlights below:

Deleveraging? $250M is coming from Fairfax next January, but SSW doesn't need anymore cash today. After the deal, the net-debt to equity is 2x and net-debt to EBITDA is 6x. Goal is under 5x EBITDA net, so they plan to use cash to prioritize lowering debt. They see the multiple going down to close to 4x within three years, then could oscillate up to 5x maximum on future deals. The deal should help SSW from a credit-quality perspective despite the temporary boost to leverage due to significant backlog.

Note: Lowering leverage is good. The obsession is starting to go a bit far in my opinion though, 4x is a very low number... 5x makes more sense as a goal.

Enhanced scale? SSW needs improved scale to better deal with the consolidating sector on the liner side of the business. They expect to be able to reach more long-term contract deals with a larger fleet. Common sense... Even after this deal, SSW only controls about 8% of the leased fleet.

What's the allocation strategy? Priority is on deleveraging and expanding the fleet, very unlikely to change dividends. They plan to delever first and then consider share repurchases as that's often a superior approach.

Note: listening to Sokol talk is a breath of fresh air compared to many shipping executives who don't understand elementary levels of capital allocation.

How does the pricing compare to historical levels? Management views the takeover as at a discount to charter-adjusted values i.e. instantaneously accretive to adjusted NAV. (Side note: I previously estimated adj. NAV was in the low-$5s, perhaps closer to $6/sh now, I will update when more disclosures are provided).Sokol mentioned the fleet was purchased for $1.6B today versus $2.6B just two years ago.

Note: Nice savings, but they also had a share price of $18.50 two years ago...

How will this impact earnings? They claim an earnings accretion of around 20%, but this seemed stretched considering the head-over-heels dilution. So, I decided to do some math of my own...

They expect $185-$200M in EBITDA from this fleet with accounting depreciation of around $50M and debt is around $1.1B at LIBOR+275 ($55-$65M), plus $50M of SSW-D at 7.95% ($4M). This suggests around $65-$90M in additional earnings. Dilution counting both sets of Fairfax equity raises and recent ATM count is around 84M shares.

Last year, SSW did $77M in "normalized" earnings, with a mid-year share count of 114M. That's $0.67 in EPS.

Going forward, we could see a midpoint of about $155M in earnings against a diluted sharecount of 200M. That's $0.78 in EPS going forward. $0.78/$0.67 = 16.4% growth. Darn close to their 20% number, and that includes the full impact from recent pre-deal dilution.

Note: I was very skeptical that this deal could overcome the hefty dilution from 2H-17, but I'm glad to be proven wrong!

Conclusion: Story Improved, Buy SSW, $8/Sh

Overall this was a great deal for SSW, I've worked through the EPS math and it is indeed accretive by 15-20% even including the recent Q4 ATM usage and the two sets of Fairfax debentures. Much more importantly, this deal is important due to the change in tone. This is no longer a retreating 'broken' firm, but rather a consolidator and a 'leader' again. In terms of valuations, our NAV target is in flux, but I'm estimating around $6/sh for now.

Our price target remains at $8/sh as I believe this is the superior container shipping company and the majority of assets, especially the smaller vessels, have significant upside. This latest transaction leaves peer Costamare further in the dust, but I will of course consider each independently on their merits going forward.

Thank you for reading this Seeking Alpha PRO article. PRO members received early access to this article and get exclusive access to Seeking Alpha's best ideas. Sign up or learn more about PRO here.

Disclosure: I am/we are long SSW.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

from Seeking Alpha Editors' Picks stocks http://ift.tt/2a97jA2

via IFTTT