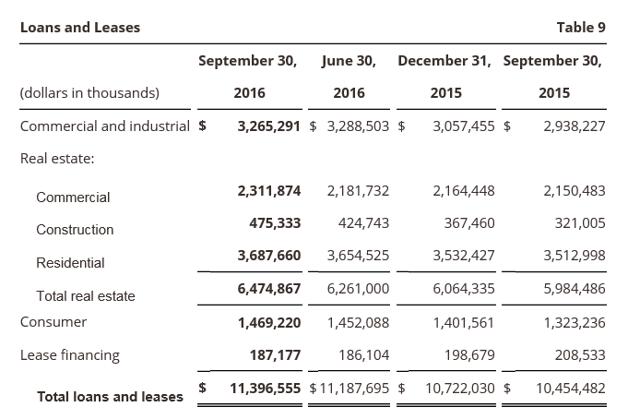

First Hawaiian (NASDAQ:FHB) is a full-service regional bank headquartered in Honolulu, Hawaii, with $19.9bn of assets, $11.4bn of loans and $17.0bn of deposits as of September 30, 2016. FHB is Hawaii's largest (by assets, loans, deposits, and market capitalization) bank.

Company overview

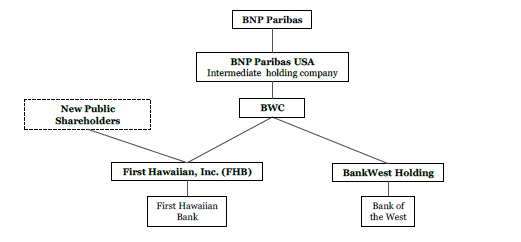

FHB was founded in 1858 and was the first bank formed in Hawaii and the second-oldest bank formed in the U.S. west of the Mississippi River. In 1998, FHB merged with Bank of the West to form BancWest, 45% owned by BNP Paribas (OTCQX:BNPQF) at that time. BNP Paribas subsequently acquired the 55% remaining shares of BancWest in 2001 and then fully consolidated the entity. In July 2016, FHB announced an IPO. The FHB IPO was priced on August 3, 2016, at $23 per share, which was at the high end of the IPO's $21-23 price range.

Source: Bloomberg

Post the IPO, BNPP is still the majority shareholder of FHB with an 84.8% stake and has five of the nine directors of FHB's board.

Source: Bloomberg

It is worth mentioning that FHB and Bank of the West have historically operated independently, each having a separate charter, board, management team and budget. In fact, BNP Paribas has had very limited daily involvement in the management of First Hawaiian.

Source: WFC Research, Company data

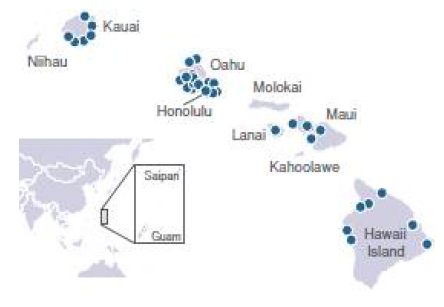

The bank conducts business primarily in Hawaii, but also has a presence in Guam and Saipan.

Source: JPMorgan, Company data

FHB offers a fairly diversified credit portfolio with a 54% commercial mix and a 46% consumer mix. Its loan book composition at Q316 was: 29% commercial, 25% commercial real estate, 33% residential real estate and 13% consumer. Relative to the bank's closest competitor and peer, Bank of Hawaii (NYSE:BOH), First Hawaiian Bank is more commercial-focused. 37% of BOH's portfolio was commercial-oriented, while 63% was consumer-oriented as of 2Q16.

First Hawaiian Bank: Loan portfolio breakdown by type

Source: Company data

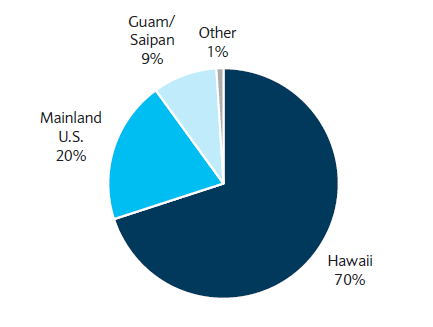

By geography, about 70% of First Hawaiian's loans are in Hawaii, followed by 9% in Guam and Saipan and 20% on the mainland U.S. FHB's U.S. mainland exposure is significantly higher than that of Bank of Hawaii. This could be largely attributed to FHB's $1.1bn mainland U.S. shared national credit portfolio and the fact that 58% of its auto dealer flooring loans were to dealers in California at 1Q16. Management believes that SNC portfolio does allow FNB to have geographic diversity to mitigate risk. The auto dealer flooring is a business that First Hawaiian has been in for over 35 years and the company expanded into the U.S. mainland in 1986.

First Hawaiian Bank: Loan portfolio breakdown by geography

Source: Barclays, Company data

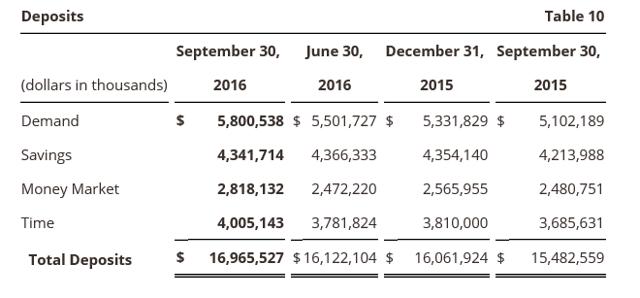

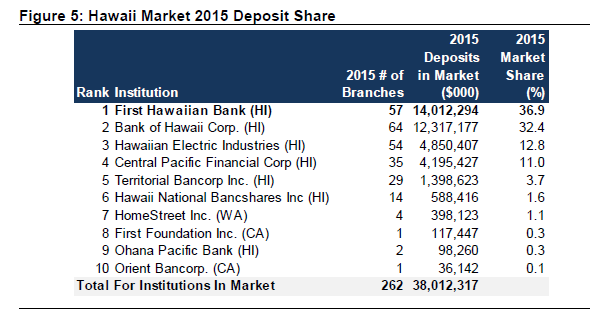

The Hawaiian banking landscape is characterized by high deposit levels, which provide attractive and stable funding. Notably, FHB has had number one deposit market share in Hawaii since 2004. In 2015, FHB had $14.0B in deposits through its 57 branches representing a 36.9% share, up from 2014, when it controlled 36.0% of Hawaiian deposits. Bank of Hawaii has the second-highest market share, at 32.4% at 2Q15, down from 33.2% in 2014.

.

Source: Credit Suisse, Company data

First Hawaiian is a classic deposit-funded bank with only 1% of its total funding coming from borrowings. The bank's loan-to-deposit ratio was just 67% as of Q316.

Source: Bloomberg

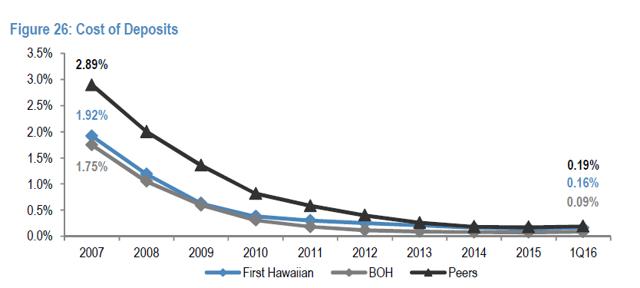

FHB enjoys such an attractive funding mix, thanks to unique features of the Hawaiian banking sector. Large U.S banks, such as JPMorgan (NYSE:JPM), Bank of America (NYSE:BAC), Citigroup (NYSE:C) and Wells Fargo (NYSE:WFC) do not have a presence in the region. As such, the Hawaiian banking sector is functioning as a classic oligopoly. Being the region's largest bank with a solid franchise, FHB enjoys low-cost deposit funding.

Source: JPMorgan, Company data

In addition, an important driving force behind FHB's low funding costs is its favorable deposit mix, with 34% of deposits being non-interest bearing.

Source: Company data

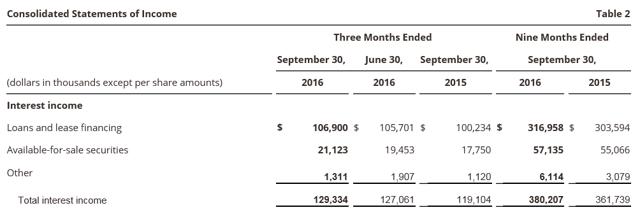

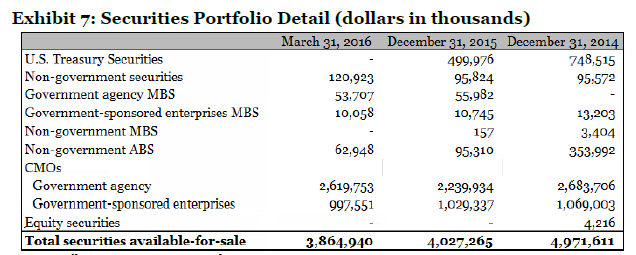

Thanks to its low loan-to-deposit ratio, FHB has plenty of excess liquidity, a significant portion of which the bank invests in securities. According to the company's management, the portfolio remains largely comprised of securities issued by U. S. government agencies.

Source: WFC Research, Company data

Notably, income from available-for-sale securities represented around 15% of the bank's 9M16 interest income.

Source: Company data

Investment summary

#1: The macroeconomic environment remains supportive

Hawaii's economy remains strong with an unemployment level that has been consistently below the U.S. average, steady population growth, a thriving tourism industry, favorable government spending and a robust real estate market.

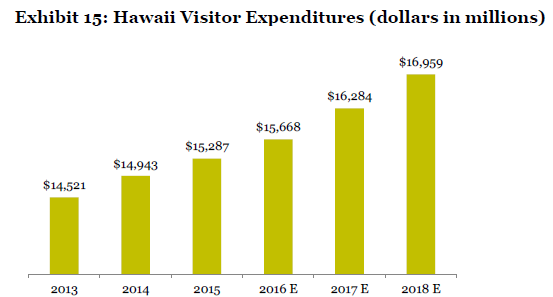

The local economy is dominated by three key segments, representing more than 65% of the region's GDP: tourism, military and real estate. According to statistics by the Hawaii Tourism Authority, total visitor spending in the Hawaiian Islands increased 10.4% to $1.2 billion in September 2016, setting a new record for the month of September and making it the fourth straight month of year-over-year increases. Total visitor arrivals to the Hawaiian Islands also set a new record for the month of September with 666,605 visitors in September 2016, a 3% increase from a year ago. Hawaiian tourism industry is expected to continue to expand in the near term with total visitors and visitor expenditures expected to grow by 5.8% and 10.9% respectively, through 2018.

Source: Hawaii Tourism Authority, WFC Research

Federal military spending is also a major force supporting the Hawaiian economy, with total government expenses representing more than 20% of the region's GDP in 2015. In fact, the state of Hawaii ranked number two in terms of U.S. military spending as a percentage of state GDP in 2015. Construction and real estate have also been significant drivers of local economy and the region's real estate market remains robust.

As of September 2016, Hawaii had the fifth lowest unemployment rate of any U.S. state (3.3%).

#2: Healthy loan growth to support top-line

FHB has experienced steady loan growth through the cycles with a 10-year CAGR of 8%. We expect this trend to continue, driven primarily by Commercial and Industrial. As mentioned earlier, First Hawaiian is more commercial-focused than its Hawaiian peers. According to the company's management, FHB has banking relationships with 77% of Hawaii's top 250 companies and the bank has a strong team of experienced full-service bankers, focusing on Commercial and Industrial. Although the bank's credit growth should be relatively balanced across all loan types, we expect stronger growth from Commercial and Industrial as the company's management believes it can continue taking market share in the local Commercial and Industrial market, thanks to its solid relationships with the region's top corporates.

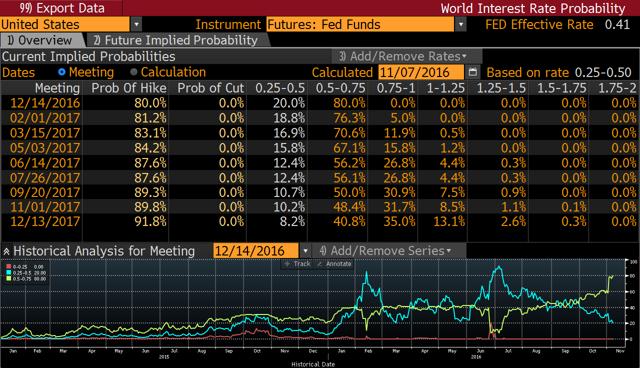

#3: Net interest margin should benefit from above-average asset sensitivity and stable deposit funding

FHB's balance sheet has an above-average sensitivity to market yields, thanks to excess liquidity at the Fed, a large securities portfolio, a high share of variable-rate Commercial and Industrial loans and stable low-cost deposit funding. As recent data suggests, the market implied probability of another rate hike by the end of 2016 at 80% and the probability of at least two more rate hikes by July 2017 is 27%. Fed tightening would support the bank's top line with an estimated benefit to net interest income of 7% from a +100bps instantaneous rate rise.

Source: Bloomberg

As noted earlier, FHB is a deposit-funded bank with only 1% of its total funding coming from borrowings. In addition, First Hawaiian enjoys a favorable deposit mix, with 34% of deposits being non-interest bearing. Thanks to high deposit levels of the Hawaiian banking market, the strength of the bank's franchise and customer loyalty, we would expect deposit re-pricing to lag asset re-pricing. This thesis is well-supported by the historical data as in the prior Fed tightening cycle, FHB's deposit beta was only 0.23x.

In addition, management plans to continue transitioning the bank's securities portfolio, looking to reposition around $3bn in 2016 into longer-duration, higher yielding securities. This re-positioning would be also supportive for the bank's NIM.

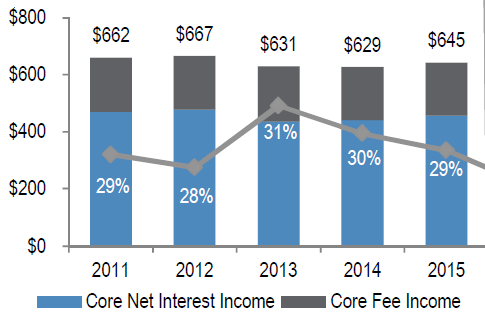

Fees & commissions income represent a significant proportion of revenue (around 30%), which is similar to FHB's peers. Having said that, F&C growth potential looks limited due to lower deposit service fees. As such, we expect interest income to be the main driver of the bank's total revenue growth.

Source: JPMorgan, Company data

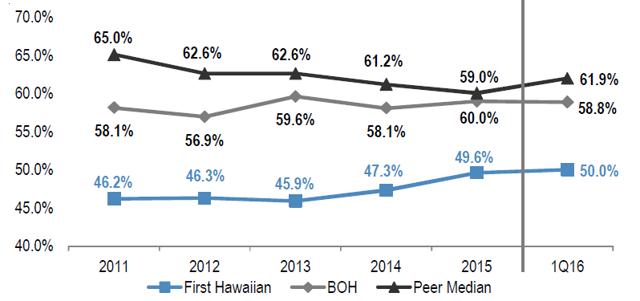

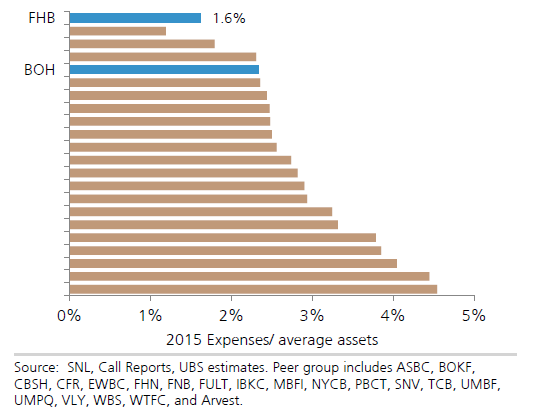

#4: Excellent cost efficiency management

First Hawaiian has historically been a very efficient organization with a company-wide focus on prudent cost management. FHB has fewer branches than its key competitor, Bank of Hawaii, and it also owns the real estate for all its branches. In addition, First Hawaiian has less need for investments in advertising, thanks to the strength of the franchise and customer loyalty. Solid expense management is reflected in the bank's cost efficiency metrics, which are running well below peers' ratio.

Source: JPMorgan, Company data

The reported efficiency ratio for Q316 increased to 48.3% from 47.0% for Q216 and 46.7% for 9M16. That being said, we believe this increase in costs is a one-off associated with becoming a public company. As such, we expect cost efficiency metrics to improve in 1H17. We also note that FHB and Bank of the West have historically operated independently. As such, the separation process will not cause a material deterioration in cost efficiency metrics, in our view.

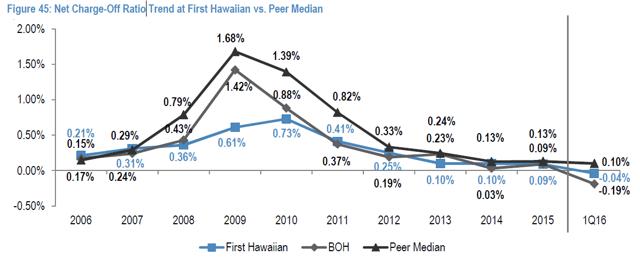

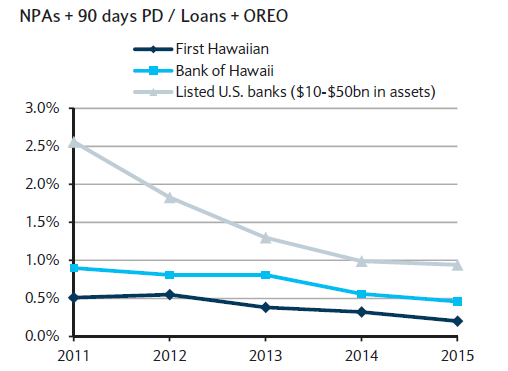

#5: Conservative approach to credit risk management

Conservative and consistent credit risk management has been an important part of FHB's corporate culture. The bank experienced fairly stable and predictable asset quality through a range of credit cycles, thanks to its conservative approach to underwriting and credit risk management. This was evident even during the 2008-09 financial crisis when the charge-offs at First Hawaiian peaked at 0.73%, which was below peers at 1.68%. In fact, conservative credit risk management has allowed FHB to remain profitable through recessions.

Source: JPMorgan, Company data

Source: Barclays, Company data

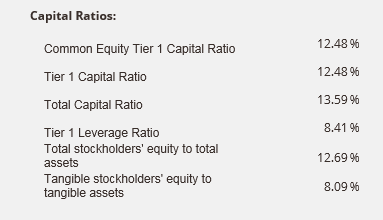

#6: Strong capital ratios give flexibility to distribute excess capital to shareholders

FHB's CET1 ratio stood at 12.85% at 3Q16, well above both the adequately and well-capitalized requirements.

Source: Company data

The bank paid an initial quarterly dividend of $0.20 per share for 3Q16, implying a dividend payout ratio of around 50% on 3Q earnings and a 3% dividend yield, based on the current price.

Source: Bloomberg

Management also noted that it intends to maintain a clear and consistent dividend policy. We expect the bank to maintain a payout ratio of 50% with FHB initiating buybacks in 2017, bringing total payout to the 80-85% range. It is worth mentioning that even the 100% payout policy would allow the group to grow its balance sheet sustainably.

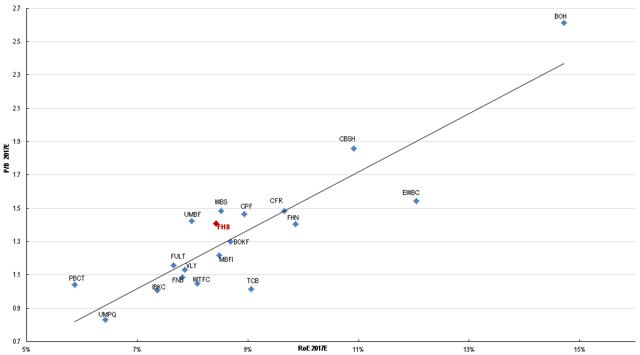

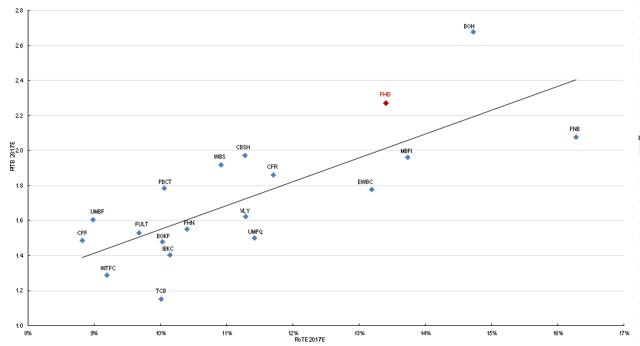

#7: We expect a valuation gap between FHB and BOH to narrow

We expect a valuation gap between FHB and BOH to narrow in light of similar macroeconomic exposure and profitability trends. We think the current BOH's premium could be in part attributed to its track-record of being a public company since 1972. However, as soon as the market comes to better know the First Hawaiian story and its unique characteristics, the gap will narrow, in our view. In fact, FHB has the potential to outperform BOH going forward on the back of a higher dividend yield, more stable credit performance, above-average interest rate sensitivity and First Hawaiian's favorable funding mix. Moreover, in terms of return on assets, First Hawaiian has also been historically ahead of peers, including BOH.

P/B vs. RoE

Source: Bloomberg, Renaissance Research

P/TB vs. RoTE

Source: Bloomberg, Renaissance Research

Source: Bloomberg, Renaissance Research

Risks

1) Geographic concentration. Given its exposure to Hawaii (around 70% of loan book and more than 80% of deposits), FHB remains exposed to a slowdown in the local economy. Changes in federal defense and military spending program, a deterioration in the tourism industry or negative trends in the real estate sector would definitely have an adverse impact on the Hawaiian economy.

2) The U.S. mainland credit portfolio. As mentioned earlier, FHB's U.S. mainland exposure is significantly higher than that of BOH. The U.S. mainland portfolio primarily consists of shared national credits and auto dealer flooring loans. Management believes that SNC portfolio does allow FNB to have geographic diversity to mitigate risk and FHB has been in both of these businesses for a long time now. Having said that, the U.S. mainland portfolio has the perception of being higher risk. As such, any asset quality deterioration in SNC portfolio would be a negative for the stock.

3) Expansion of large U.S. banks. Large U.S banks, such as JPMorgan, Bank of America, Citigroup and Wells Fargo do not have a presence in the region, with the Hawaiian banking market functioning as a classic oligopoly. Should mega-banks start to focus more on opportunities in Hawaii, the region's banking landscape would face significant transformations, which would have negative consequences for FHB and its Hawaiian peers.

4) Overhang risks. BNP Paribas is likely to sell its remaining 84.9% stake in First Hawaiian. This could create an overhang on shares as BNPP unwinds its position over time.

5) CCAR and capital deployment plans. Given BNP Paribas' ownership stake, FHB will continue to be subject to the Fed's Comprehensive Capital Analysis and Review (CCAR) process. As such, FHB's capital management plans are not entirely under its control.

Bottom line

We view First Hawaiian Bank as a high-quality name operating in attractive markets with resilient margins, a conservative credit risk profile, stable low-cost deposit funding, superior cost efficiency metrics, solid capital ratios and an attractive dividend yield. In our view, the bank is well-positioned to outperform its peers.

As a buy-side analyst and a deputy portfolio manager, I oversee a financials-focused fund, and will be continuously providing research coverage on small underfollowed names, like First Hawaiian. If you are interested in the topic, consider following us by clicking the "Follow" button beside our name at the top of the page. Thank you for reading.

Disclosure: I am/we are long JPM, BNPQF.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

from Seeking Alpha Editors' Picks stocks http://seekingalpha.com

via IFTTT