User Exodus Didn't Materialize In Q3 ... And It Won't In The Future

In my last article on Facebook (NASDAQ:FB) , I lowered my price target on Facebook from $240 to $220. I was fearful that Facebook would report a Q3 users exodus in not just Europe, but North America as well. Europe and North America are by far Facebook's largest markets for monetization, so any weakness from Facebook in either one of these markets can have an adverse, and material affect on Facebook's revenue growth. But in Q3, Facebook reported results that were in some ways better than Q2 on the user side.

(source: Facebook IR)

(source: Facebook IR)

In Q2, Facebook lost 3 million DAUs from Europe, a 1% sequential decline. This came mainly at the hands of GDPR's impact on user growth. In Q3 however, Facebook only lost 1 million DAUs in Europe, despite management's Q2 warning about DAUs being hit harder as GDPR takes full effect. Meanwhile, Facebook's North American DAU count stayed flat for the third straight quarter, at 185 million DAUs, showing that Facebook's relevance in the US and Canada hasn't budged.

The question now is if a user exodus will ever materialize. In my opinion, no massive user exodus will come to fruition, which is necessary to trigger a massive slowdown in core Facebook's revenue growth. As of the Q3 data, a user exodus coming from any of Facebook's major geographies seems like a faraway chance. In my opinion, Facebook's user base should continue to grow, the question is at what rate. Wall Street seems to be pricing in a catastrophic hit to core Facebook's user numbers, whereas the Q3 data and confidence displayed by management suggests quite the contrary.

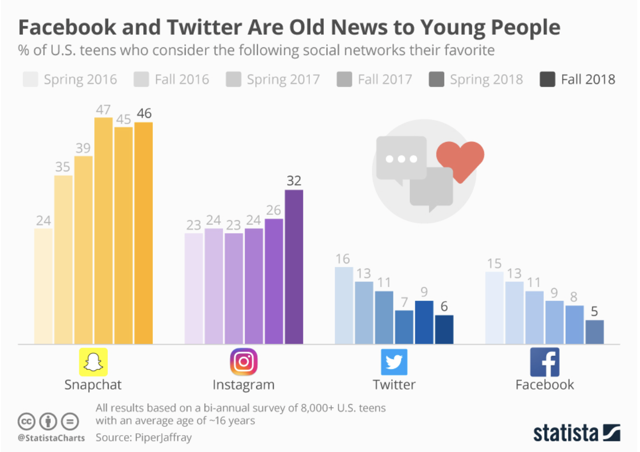

That being said, younger people and millennials as a demographic are leaving Facebook. Ever since older generations have adopted the Facebook platform, Facebook has lost its cool factor, and is nearly irrelevant amongst teens. Even Twitter is more relevant amongst teens.

Facebook is expected to lose 2.2 million 12-17 year olds by 2022. Future purchasing trends are dictated by Generation Z/teens, with millennials dictating current purchasing decisions. And with Facebook losing users in this key segment, advertisers may be more hesitant to use Facebook for their advertising needs. However, Facebook remains strong amongst older users. Facebook's user base is active and while stalling remains lucrative for advertisers and will continue to be in the future.

Facebook is expected to lose 2.2 million 12-17 year olds by 2022. Future purchasing trends are dictated by Generation Z/teens, with millennials dictating current purchasing decisions. And with Facebook losing users in this key segment, advertisers may be more hesitant to use Facebook for their advertising needs. However, Facebook remains strong amongst older users. Facebook's user base is active and while stalling remains lucrative for advertisers and will continue to be in the future.

In addition, Facebook has "sweeteners" for user in place. Products like Facebook Watch and Stories may eventually keep users drawn to the Facebook platform, and prevent the Titanic-esque sinking in Facebook's user numbers that some have predicted.

Core Facebook's Monetization Runway

Facebook's previous astonishing revenue growth rates came from the company's ability to combine robust user growth in key markets (North America and Europe) with increased monetization of the Facebook platform. As Q3 demonstrated, the user growth in Facebook's core markets is beginning to slow if not completely stagnate. The only DAU user growth is coming from Facebook's Asia/Pacific and rest-of-world (ROW) segments. In my opinion however, core Facebook doesn't need high levels of DAU growth to increase its core revenue at strong growth rates. The real long-term path for the core Facebook platform's growth comes from Facebook further ability to monetize the platform. I believe the combination of the oligopolistic trend in the internet advertising space, the growth of the overall space, and Facebook's market leadership and coming market share gains will all act as tailwinds for core Facebook's monetization.

In my opinion, the internet advertising space is controlled by two main players, with a third emerging. Those two players are Facebook and Google, with Amazon (NASDAQ:AMZN) being the emerging player. Ever since Facebook began gaining traction amongst advertisers, the company has developed high-quality ROI that have made them and Google (NASDAQ:GOOG) the two "must haves" in the internet advertising world. The main reason Facebook has been able to generate this massive ROI has been its ad targeting practices. Recently, these practices have been held in a negative light, with regulators and sell-side research analysts becoming increasingly skeptical of Facebook's ability to continue their current targeting. Facebook has been accused of scraping every bit of data on the user, and even tracking that user as he/she operates across the internet and into the offline world. All of these measures allow Facebook to create a digital profile on each of these people.

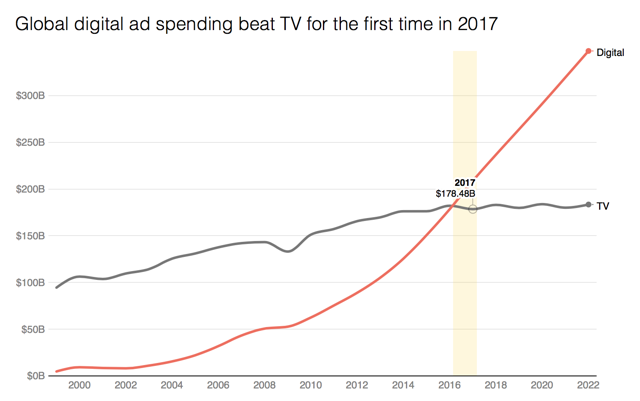

While this may be deemed unethical, the nature of the internet advertising industry has always been the advertiser's ability to target its users most effectively for advertisements. Before internet platforms like Facebook and Google, marketers relied on legacy media platforms like TV and print for their marketing needs. While these marketing platforms are still used today, the ROI on advertisements from legacy platforms is substantially lower than that from internet based platforms. Why? It is simply because these marketers don't know precisely who they are targeting through a TV screen. The marketers only the basics about who is watching the ads. Think of the user as a puzzle. Marketers have only one piece of the puzzle with legacy platforms. Whereas marketers that utilize the internet have nearly the whole puzzle right in front of them. And best of all, it is actually cheaper on a CPM basis to use Facebook than to run TV ads. So Facebook is less expensive and offers better long-term products to marketers. Here is the current expectation for the 2019 market relative to the 2016 market.

From 2016 to 2019, mobile's share of the pie is expected to grow from just 15% to 27% in three years. Meanwhile, Facebook's CPM is roughly $7. In comparison, TV CPM is at ~$17.

From 2016 to 2019, mobile's share of the pie is expected to grow from just 15% to 27% in three years. Meanwhile, Facebook's CPM is roughly $7. In comparison, TV CPM is at ~$17.

(source: Statista)

(source: Statista)

All we need is for a negative catalyst to hit legacy media. In my opinion, the increased competition from platforms like Netflix (NASDAQ:NFLX), Roku (NASDAQ:ROKU), and some of the legacy media companies themselves in the OTT streaming market could provide a legitimate threat to TV and print to expand. All it will take is for some of the recurring ad buyers to see a drop-off in usage of TV and print media for these firms to pull their budgets from legacy media and plop it into the next best thing. Again, Facebook has a $7 CPM versus TV's CPM of $17, meaning you can get better targeting, ROI, and are reaching a far larger audience, for ~40% of the price. And with Facebook being the market leader in this huge market, it seems like Facebook would be a likely target for these budgets.

This market is massive, coming in at $178 billion in total spending for 2017.

(source: Recode)

(source: Recode)

Ironically, the same legacy media companies that are at risk, are actually accelerating the demise of their old selves. Shedding their old skin and reinventing what it means to be say Comcast (NASDAQ:CMCSA) or CBS (NYSE:CBS), by entering the same streaming market that is eating away market share from their traditional over-the-air media businesses.

And finally, a key catalyst for recurring marketing on legacy platforms is exposure to one-time events that will occur regularly. Such events include the Olympics, the NFL, or most recently the midterm elections. People regularly tune into TV stations to watch these events play out. But increasingly, these events are coming to social media, with Twitter (NYSE:TWTR) streaming live NFL games, Snap (NYSE:SNAP) bringing the Olympics to its users, and Facebook itself becoming a key source of news for its users. The internet advertising space is quickly closing in on legacy media, and legacy media appears to be attempting a reinvention of itself to survive.

Regulators Won't Do Anything

Another critical component to the bear argument is that regulators will crack down on Facebook's ability to operate their current business model. There is a saying that I believe rings true here:

"There is either no regulation, or there is either way too much regulation."

In my opinion, the odds of any material regulation infringing on Facebook's ability to do business is a long-shot chance. Why? Let's first look at Facebook's lobbying dollars relative to others.

(source: Recode)

(source: Recode)

Meanwhile, competitor Google spent $18 million last year on lobbying, with Amazon spending $12.8 million. But Google and Amazon are working on products that could change industry, and need a nod from regulators to allow them to develop these products. Such products include Google's Waymo autonomous driving division. Facebook on the other hand, hasn't created some new product, and has been hit with PR nightmare after PR nightmare. If anything, Facebook's lobbying spend will probably increase again this year, with more and more PR issues mounting against Facebook ever since the Cambridge Analytica scandal.

(source: The Wrap)

(source: The Wrap)

Even if we look to the EU and GDPR, there is no adverse affect on Facebook's monetization path as much as there is an effect on Facebook's user count in Europe. Lobbying, as far as I know, is legal in Europe. And while I don't have the numbers for how much Facebook is lobbying in the EU, I believe Facebook could have some form of lobbying efforts. That being said, when you turn to small businesses, you see that small businesses (for the most part) are putting their marketing budgets into internet platforms like Google and Facebook. This is because of the low cost and elevated ROI these platforms deliver to users. If regulators crack down significantly on Facebook's monetization efforts, then small businesses (a key running point) are adversely effected. Because of that, the likelihood of regulators, at least in the US, implementing some form of meaningful regulation on Facebook are unlikely.

Another point I would like to make about European regulation, is the fact that regulators have done very little to hurt Facebook's business. The EU has slapped fines that are minuscule to Facebook's overall revenue stream and that are one time occurrences. And with GDPR, no real changes are made to the way Facebook operates in Europe. Simply, Facebook provides greater clarification to its users about what Facebook is doing with it's users data, and tells them in a down-to-earth and simple way. This is why we get less users from Europe, but the continuation of strong ARPU.

Until Facebook directly and adversely effects the politicians regulating Facebook, do not expect much change coming to Facebook's business model.

Amazon Isn't A Threat, Yet

A key argument that has been promoted by the bears on both Facebook and Google, but particularly with Facebook, is that Amazon is going to take market share from Facebook and Google in the ads space with Amazon's new advertisement offerings. In many surveys, some marketers actually have allocated some of their budgets to Amazon and away from Google/Facebook. However, there are a few reasons that Amazon's ads business will not take share from Facebook/Google, yet.

First of all, Amazon's internet advertising business is built around ads served on the Amazon site, which limits these ads to consumer goods. Amazon's advertisement platform is niche. The real problem is, how will Amazon move from purely consumer goods sold directly through Amazon, to the entire ads space encompassing all different products? It will be difficult, and a roadblock that Amazon will get over. But it is all in due time.

Secondly, Amazon's ad services are new, with no proof thus far that this business can generate higher ROI than Facebook/Google with competitive pricing. Amazon legitimately be a threat to Facebook/Google in ads, but they are yet to demonstrate the ROI that would allow Amazon to take meaningful share from the Facebook/Google duopoly. Until Amazon does that, it is not a real threat.

Core Facebook Targets

For this DCF model, I break up the Facebook business into Instagram and Facebook. I will start by giving my five year targets for core Facebook, and then give my targets for Instagram later. If you are wondering about the lack of WhatsApp and other growth initiatives, it is simply because any target with other businesses is much more arbitrary.

Facebook calculates ARPU based on its MAU number, not its DAU number. In general, I expect a continuation of the current trend, with Asia and ROW to continue MAU growth, and Europe/North America to slowly fade. As you can see however, I expect gains in ARPU/monetization despite user loss. This model assumes a revenue CAGR of 7.8%, an attempt to express how core Facebook's slowing growth days are ahead of it.

Facebook calculates ARPU based on its MAU number, not its DAU number. In general, I expect a continuation of the current trend, with Asia and ROW to continue MAU growth, and Europe/North America to slowly fade. As you can see however, I expect gains in ARPU/monetization despite user loss. This model assumes a revenue CAGR of 7.8%, an attempt to express how core Facebook's slowing growth days are ahead of it.

Facebook Is A Growth Company

As I showed above, I do not believe the core Facebook platform is itself a rapidly growing revenue generator. As a matter of fact, I believe the current slowing user growth numbers that Facebook has delivered over the last few quarters will be a recurring theme over the years to come, with continued deceleration in user growth ahead. And even then, a revenue CAGR of 8% isn't exactly a growth number. That being said, Facebook is a growth company. The growth from Facebook will come from Facebook's suite of platforms.

(source: Business Insider)

(source: Business Insider)

The Facebook business has leapfrogged from a slowly growing and again platform, to having one of the richest online ecosystems on the planet. Facebook will play an integral part in the development of technology for years to come. This is based solely on Facebook's relevancy in the tech space. Let's look at each of these avenues.

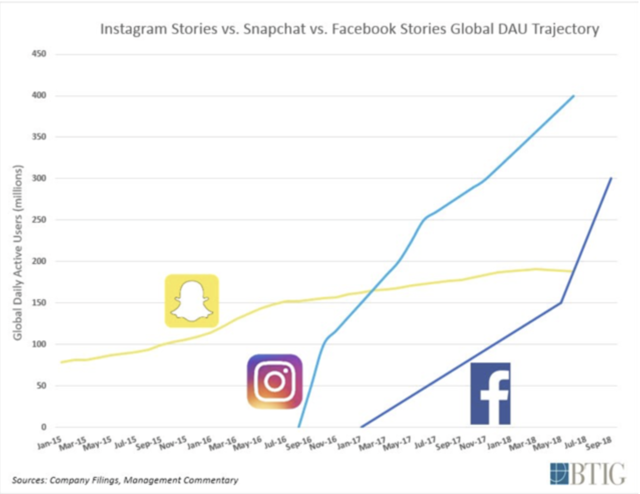

Instagram: First up is Instagram. Instagram has become an increasingly relevant platform in society. In my opinion, Instagram is the most important part of Facebook's growth story. Instagram is a very relevant platform, with 400 million DAUs of Instagram's Stories feature, and 1 billion MAUs.

Ever since Instagram copied Snapchat's hit "Stories" feature, it has gained enormous traction, with Instagram even pulling users away from the platform that created the product, Snapchat. Stories have become so relevant amongst Instagram users, that Facebook is in the middle of a slow transition from the core Newsfeed to Stories, a transition that has led to slower than anticipated revenue growth rates. Revenue growth has indeed slowed, but Stories are setting up to be the next Newsfeed in the mobile frontier. While Wall Street sell-side analysts freak out about Facebook's decelerating revenue growth rate, they are failing to gauge the context of this deceleration. It is only inevitable that advertisers switch to the higher ROI and stickier mediums. This new medium is Stories, and Facebook is making the transition into this arena.

The best part about Instagram is that Instagram is yet to make any meaningful moves in monetization, particularly with advertisements. Eventually, Instagram will be so large and impactful on Facebook's overall revenue, that Instagram will break out the user and monetization data. Until that time however, there is a certain randomness to assumptions about Instagram's business. There is plenty of room for Instagram to run, with Instagram taking young users that leave the Facebook and Snapchat platforms.

But the real reason that Instagram has such a strong future is the lack of a competitive threat on the horizon. Instagram's greatest and most relevant competitor has been Snapchat. But Instagram has proven time after time that Instagram just beats Snapchat. Here is how it works: Snapchat will spend hundreds of millions of dollars per year in R&D and build some new product. If this product proves to be a hit, then Instagram comes along and copies it, and gains more traction on the Instagram platform at Snap's expense. And because Snap doesn't have this software legally protected, Instagram can walk away with millions of dollars of software for free.

The key mistake Snap has made that Instagram hasn't made is about listening to the user base. When many users are annoyed with a new feature on Instagram, the team at Instagram fixes it right away. Whereas the Snap team has believe that Snap knows more about what is right for the platform than the user does. If the user doesn't like the experience, there is no rule saying that they have to continue using the platform. Instagram has worked for users, Snapchat has not.

As such, it is not a surprise that Snap's user base has been shrinking.

(source: Snap IR)

(source: Snap IR)

And while I am no longer short Snap, my entire short thesis and short position was based around the belief that Instagram would take users from Snap. Sure enough, Snap has been losing users.

There is no denying it. Facebook's Instagram is increasing in relevancy and is becoming one of the most important platforms across all age groups and demographics. Facebook may eventually ARPU near the levels that Facebook is at.

The following ARPU data is based on the number of DAUs instead of MAUs. If I estimated Instagram's MAUs, then ARPU would be much higher.

Again, it is difficult to do an in depth breakdown of Instagram because the data points are scarce, being updated every few quarters instead of every quarter. As Instagram plays a greater role in the overall Facebook business, we should expect Facebook to break out Instagram in its earnings releases. Next you have Facebook's messaging platforms, WhatsApp/Facebook Messenger.

Again, it is difficult to do an in depth breakdown of Instagram because the data points are scarce, being updated every few quarters instead of every quarter. As Instagram plays a greater role in the overall Facebook business, we should expect Facebook to break out Instagram in its earnings releases. Next you have Facebook's messaging platforms, WhatsApp/Facebook Messenger.

WhatsApp/Messenger: To be clear, I am not pricing in any impact from products outside of Facebook and Instagram in my DCF model. In my opinion, estimating users and ARPU for platforms like WhatsApp, and revenue for Oculus is almost completely arbitrary. As such, I'm only providing my analysis on this platform.

Thus far, Facebook's messaging apps have reached significant scale, but nearly no monetization. This is to be expected however, as monetizing chat based platforms is more difficult. Showing advertisements via chat just doesn't work, with Snapchat acting as living proof. I still believe however that the messaging apps have plenty of monetization runways ahead of it. First of all, WhatsApp is not completely a chat app. It also holds its own Stories-esque feature known as WhatsApp Status. But advertising isn't the only monetization runway that Facebook has with regards to its messaging platforms. Facebook has created a credit tracking program installed into Facebook Messenger, and has an opportunity to expand into the mobile payments business, a business that Facebook has said they are interested in for some time. And while the monetization of these services is set to be far lower then the core advertisements placings in Instagram and Facebook, the sheer scale of the user base should boost drive revenue growth from this segment of Facebook's business.

I don't break out this segment of Facebook's business, solely because of a lack of data on monetization and user growth. There is also potential for this monetization initiative to be a total flop, as Snap has had extreme difficulty monetizing its mostly chat based user base.

Overall, Facebook's growth trajectory will come from these two products, but further growth could come from products like eCommerce, Oculus (NYSE:VR), Facebook's AI tools, original content, smart speakers, and IGTV. Facebook, while projected as a company that is taking society backwards, is actually investing heavily in R&D and future innovative projects, mostly pertaining to software development. To believe Facebook is standing still, or even going backwards is a key flaw that could spell ruin for the bear thesis.

Valuation

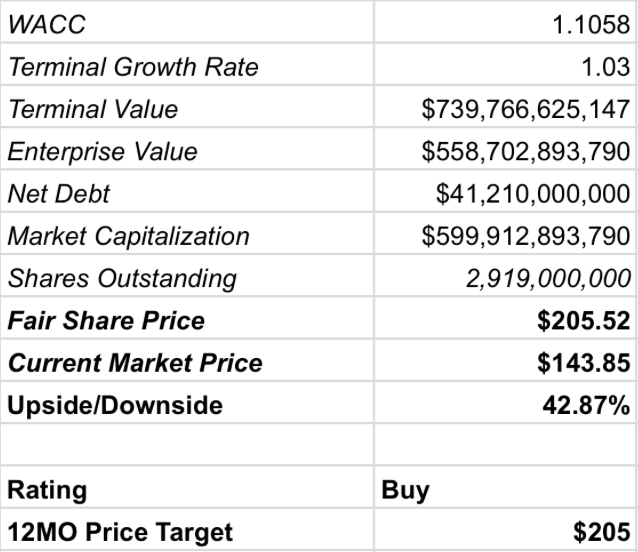

For this valuation (and basically every valuation I perform), I will be using a discounted cash flow model. Currently, Facebook is debt free, and has $41.21 billion sitting in cash as of fiscal Q3. Facebook ginormous cash pile is another key reason I own the stock. On an ex-cash basis, Facebook trades at ~17X 2019 expected earnings, with 24.7% revenue growth. If you value Facebook at a PEG of 1 on consensus EPS and growth rates, then Facebook stock would be valued at ~$184. The stock is at ~$144. So using a simple PEG ratio gets me to a target of 28% upside. But the discounted cash flow model spells upside greater than 28%.

Here are my calculations for cost of equity:

This assumes an equity risk premium of 5.32% against the 10 year bond's yield of 3.114%. Facebook's one year unlevered beta is 1.39.

This assumes an equity risk premium of 5.32% against the 10 year bond's yield of 3.114%. Facebook's one year unlevered beta is 1.39.

Because Facebook lacks debt and a cost of debt, the cost of equity is equal to the WACC. So Facebook's WACC is 10.51%. This is further verified, as Credit Suisse analyst Stephen Ju uses a WACC of 10.5% in his DCF valuation of Facebook.

Here are the combined estimates for Facebook's business over the next five years:

To value the stock, I'm using a terminal growth rate of 3%. Here is the valuation of the stock:

To value the stock, I'm using a terminal growth rate of 3%. Here is the valuation of the stock:

Conclusion

The current market price of Facebook's stock more than bakes in the risk associated with Facebook. The company's stock trades at a seemingly value multiple, while being a growth business. The headwinds forecasted by bears are irrational. Eventually, when Facebook overcomes these fears, the market will realize Facebook for what it is, a growth giant with a portfolio of some of the most valuable digital assets in existence. Coupled with strong financials, improving user count, and a long-term positive trend in ARPU, the bears are just plain wrong. Facebook remains a buy.

Disclosure: I am/we are long FB, GOOG.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not a financial adviser. This is not financial advice. Everything said here is my personal opinion. Please do your own due diligence with regards to investments in these securities.

from Seeking Alpha Editors' Picks stocks https://ift.tt/2a97jA2

via IFTTT