Overview

Trading near of below book value since the end of the global financial crisis, Citigroup Inc. (C) has disappointed investors and has underperformed its peers in the U.S. financials sector. After teetering on the brink of collapse after the financial crisis, Citi has gone through a lengthy process of paring down its sprawling network and reinventing itself as a more focused organization. With a physical presence in 98 markets around the world, Citi is a global industry leader with a geographically diversified footprint. Citi has a significant interest in developed and developing markets in Asia and Latin America, helping to diversify its revenues and risks from the U.S. domestic market.

After nearly a decade of shedding businesses, divesting assets and shoring up its balance sheet, Citi has made significant progress in reinventing the company and refocusing its direction. With the heavy lifting of its restructuring and refocusing complete, CEO Michael Corbat can now focus on his two major priorities for the firm: enhancing return on capital and return of capital. With the positive macro environment of a strong U.S. domestic economy, rising interest rates, tax reform and a favourable regulatory environment, Citi is well positioned to reward shareholders. With these positive catalysts, Citi will be returning value to investors through a massive program of share buy backs, steady dividend increases and ultimately share price appreciation.

Source: Reuters

Institutional Clients Group

Citi operates in two main business segments: Global Consumer Banking (GCB) & Institutional Clients Group (ICG). Citi’s Institutional Clients Group operates an impressive financial network with trading floors in 77 markets, and a physical presence in 98 countries worldwide. Based on its scale, Citi can boast to serving up to 90% of Fortune 500 firms and manages a clearing network of approximately $4T daily. With revenues of just under $35B in 2017, the ICG segment is slightly larger than the GCB business and saw revenue growth of 9% in 2017. In H1 2018, net income increased by 17%; driven primarily by revenue growth and tax reform. Citi is targeting CAGR in ICG revenue of 4% or better through 2020 and anticipates achieving Return on Tangible Common Equity (RoTCE) of 14% or better. Due to the scale and well established network in the institutional space, Citi expects that they can achieve an efficiency ratio of 50% by adding more volume without adding cost and leveraging scale to take advantage of large network advantages.

Global Consumer Banking

Citi’s truly global brand differentiates it from more domestically focused rivals such as (WFC), (BAC) and (JPM). With over 100M customers worldwide, Citi is the lender of choice and top wealth manager in markets around the globe and can boast being the largest issuer of credit cards in the world. This geographical diversification is part of the reason why Citi hasn’t enjoyed the same benefits as its domestic peers resulting from the growth of the domestic U.S. economy. For this reason, Citi is better positioned to continue to benefit from growth in Asia and Latin America, ensuring that it will withstand a slowdown in the U.S. economy better than its peers.

As part of its path towards increasing efficiency, Citi has divested more than $800B in non-core assets, exited consumer markets and reduced head count. Reducing its footprint in global consumer markets by exiting select cities was a significant challenge as the bank had to find a way to leave select markets while still remaining “global”. In the U.S. for example, Citi has concentrated its retail banking in major urban centres such as Washington DC, Chicago, Miami, San Francisco, New York and Los Angeles, while exiting less desirable, less profitable cities.

Results in this segment have been positive, with Citi experiencing 4% growth in Global Consumer Banking revenue for 2017. For the six months ended in June 2018, revenue is up 5% over the period, with net income up an impressive 26% compared to the first half of 2017. On a geographic basis, net income growth for the first half of 2018 was up 23% in North America, 27% in Asia and 39% in Latin America compared to the year prior. Exposure to these developing economies will offer strong loan growth and good margins going forward for the Global Consumer Banking segment. According to the firm’s estimates on earnings growth for 2018 and beyond, GCB should deliver ~2/3 of earnings driven improvement, with ICG contributing the remaining ~1/3. Citi’s leverage to emerging markets in its GCB business is a significant driver of this growth.

Improving Results and Continued Growth

Despite continued weakness in the share price, Citi’s operating results have been improving. Since 2008, Citi has been working to refocus its businesses, execute on strategy and achieve better operating results. Improving its operating results will be key to regaining investor confidence and expanding its earnings multiple. In the second quarter of 2018, Citi reported a 16% increase in net income on a 2% increase in revenue YoY.

Source: Citi Q2 2018 YoY Results

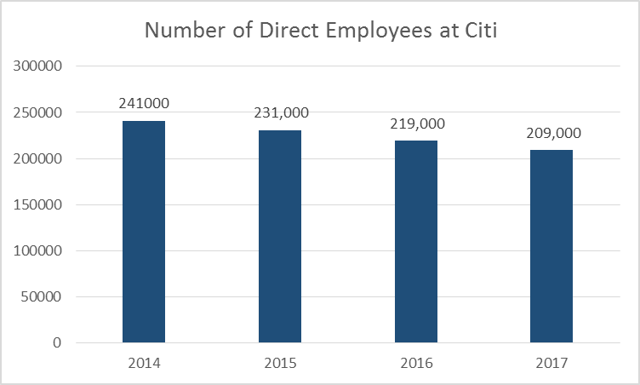

At approximately 0.98, Citi’s price to book ratio has also improved, up from a 5-year average of 0.8. Likewise, return on assets (ROA) is nearing 1% and is up 25bps over 2012-2017. Another positive efficiency indicator for Citi is its demonstrated improvement in revenue per employee. Since 2015, Citi has simultaneously decreased head count from 231K to 209K (as of 2017) while increasing revenue per employee from $324K to $349K.

Data Source: Statista

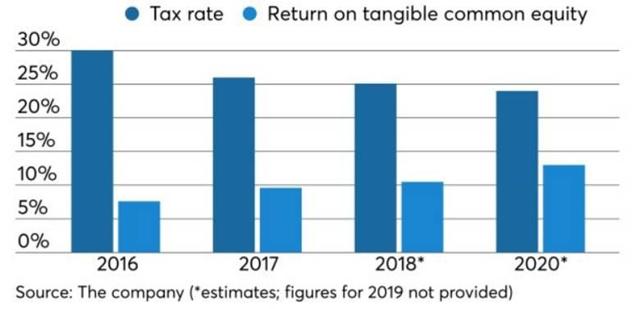

Like its peers, Citi has benefited from positive changes to the firm’s effective tax rate. For the second quarter of 2018, Citi’s effective tax rate was 24.3%, compared to 31.6% in the second quarter of 2017. Despite its leverage to emerging markets, Citi’s U.S. domestic exposure is significant, making it a major beneficiary of U.S. tax reform. In the domestic U.S. market, Citi has 9.1M customers and $182B in deposits. Tax reform, coupled with a strong U.S. economy and low unemployment will continue to drive positive results for Citi’s domestic business.

Source: American Banker

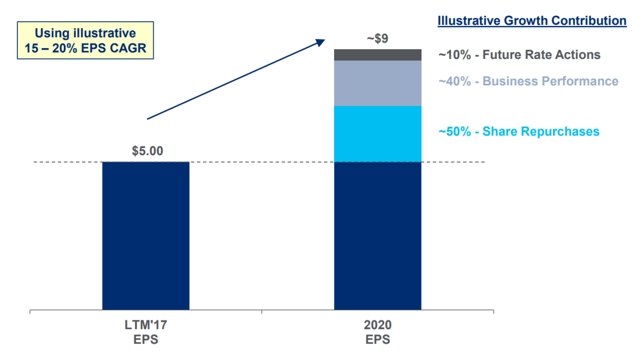

As a sizeable holder of domestic U.S. deposits, Citi will benefit from rising interest rates in the United States. With 3/4s of Citi’s interest rate sensitivity driven by changes in U.S. rates, the bank should enjoy net interest margin improvements as the Federal Reserve increases rates. According to Eric Compton of Morningstar, Citi’s net interest margin should improve to approximately 3.1% by 2022,up from 2.7% in 2017. Citi appraises that future rate actions should contribute 10% to EPS growth towards 20202 with ~40% coming from improved business performance and ~50% from share repurchases. The firm suggests that these factors will contribute to robust EPS growth of ~$9/ share in 2020.

Source: Citi Investor Day

Achieving a $100/Share Valuation

Over the last 6 months, Citi has traded in a narrow range between the mid 60s and the mid 70s, approximately 10% down from its January 2018 high of $80.70. Given the tailwinds in 2018, its difficult to see why the stock has underperformed. With rising interest rates, a strong domestic economy, positive CCAR results and a lower effective tax rate all working in Citi’s favour, there is a compelling case that the share price has a long runway.

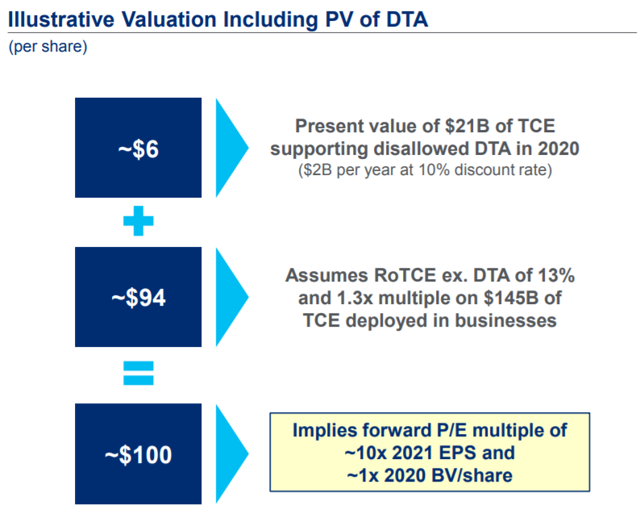

In the 2017 investor day presentation, Citi CFO, John Gerspach suggests that even at 1.0 P/B share price should increase ~50% from July 2017 levels. With a closing share price of $68.03 as of July 25, 2017 (Citi Investor Day), Gerspach implies a 2020 valuation at just over $102/share. This valuation assumes RoTCE ex. DTA (Deferred Tax Assets) of 13% and 1.3x multiple on $145B of TCE (Tangible Common Equity) deployed in the business. A valuation at this level would include a forward P/E multiple of ~10x and ~1x 2020 BV/share. A share price of ~$102 in 2020 would suggest a 41% upside over the next ~2 years, or an annual total return of approximately 23%.

Source: Citi Investor Day

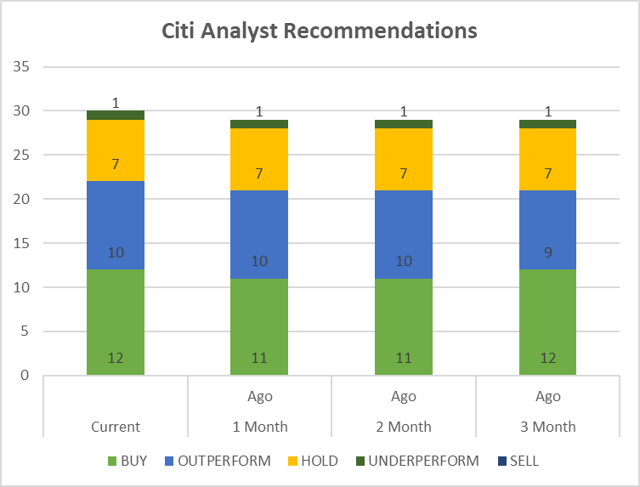

Morningstar expects that RoTCE will increase to 12.5% in 2019 on its way to Citi’s 2020 goal of 13%. With this RoTCE improvement coupled with a boost in EPS from earnings growth and buy backs, annual share price growth of ~20% looks achievable. The 30 analysts who cover the stock currently have an average one year price target of $84.62, for a one year total return of ~19.5%. Current analyst recommendations from Reuters include: 12 buys, 10 outperforms, 7 holds and 1 underperform suggesting that analysts see a value opportunity as well as a visibility towards significant share price appreciation. Given these estimates, a 2020 share price of ~$100 seems reasonable.

Data Source: Reuters

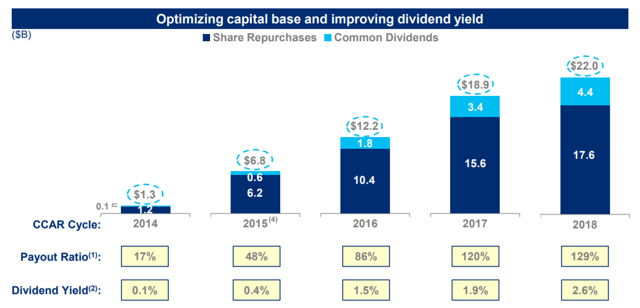

Returning Capital to Shareholders

By virtue of Citi’s status as a systematically important financial institution, Citi’s capital plan is subject to approval from the Large Institution Supervision Coordinating Committee (LISCC) through the Federal Reserve. Citi achieved positive results in the 2018 Federal Reserve Comprehensive Capital Analysis and Review (CCAR) "stress test". With this affirmation from the Federal Reserve that Citi’s capital availability and financial strength is more than adequate to absorb losses in severely adverse scenarios, Citi has the green light to continue on with its plan to return massive amounts of capital to shareholders. With a stated intention to return at least $40B of capital to shareholders through dividends and share repurchases over the 2018 & 2019 CCAR cycles. Having achieved stability and satisfied the CCAR requirements, Citi now plans to start reducing its CET1 Capital Ratio to required levels in order to drive additional growth.

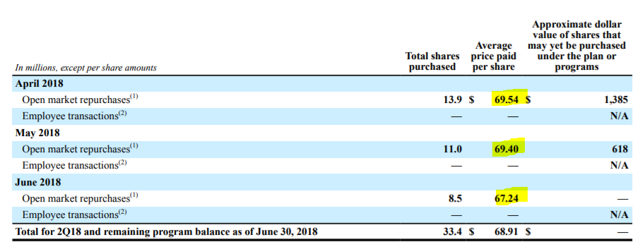

Source: Citi Q10 Filing

Source: Citi Q10 Filing

Returning capital to shareholders has been the signature policy of Citi’s rebuilding phase over the last few years. Citi is currently well into its commitment of buying back $17.6B in shares and on track to return $4.4B in dividends for a total of $20B in capital returned to shareholders over the 2018 CCAR cycle. In 2017, the result of $15.6B in buy backs was a 5% decline in average diluted shares outstanding and 6% growth in EPS, the 2018 results should be even more impactful.

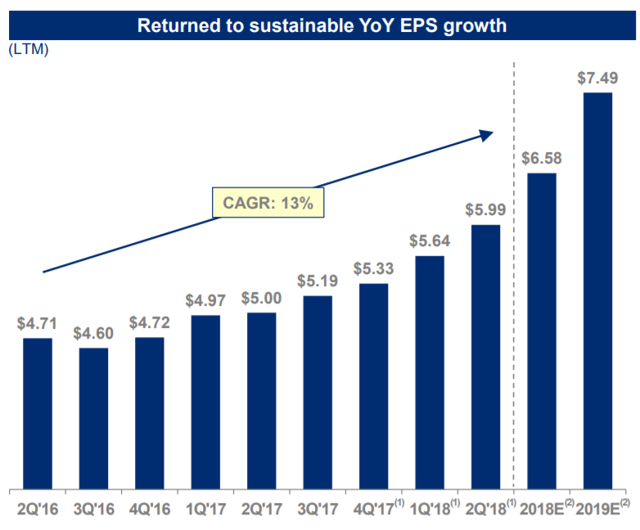

The impact of share buy backs on such a large scale has been a steady boost in EPS. Over the last 2 years, Citi has increased EPS at a CAGR of 13%. According to Citi’s estimates, EPS should rise to $7.49, a 13.8% increase. Share buy backs over the last few years have been especially valuable for investors as the stock has continued to trade at or below its book value, allowing Citi to buy back their own stock at a discount to tangible book value. The impact of share buy backs over the next few years will continue to be positive for shareholders but will have diminishing value as the share price increases.

Source: Citi Investor Data

Dividend Growth

While Citi’s share price has been slow to respond to the strong catalysts for the company’s earnings, the generous dividend increases have rewarded shareholder’s patience. With a paltry dividend of just $0.01 per quarter as recently as 2015, Citi’s dividend has increased dramatically over the last three years with a growth rate of 188.40% annually. With a 2018 increase of ~40%, the distribution of $0.45/quarter now represents a respectable yield of ~2.50%, comparing favourably to the sector average of 2.03%.

Future dividend increases will be supported by earnings growth and will likely be an increasingly important part of Citi’s plan to return capital to shareholders. As the share price rises, dividend increases will be a more attractive option for returning capital than share repurchases. The robust growth in Citi’s dividend is evidence that both Management, and the Federal Reserve, through the CCAR have confidence in Citi’s potential to continue earning growth.

Source: Citi Investor Data

Source: Citi Investor Data

Risk Analysis

Despite achieving positive results, Citi stock has yet to hold onto any momentum and as a result has underperformed its peers. CEO, Michael Corbat still has a number of challenges ahead to convince investors that the firm can achieve its stated operating goals. By virtue of Citi’s massive global scale, the bank’s sheer size and geographic breadth present a unique challenge for Citi’s CEO as he works towards executing strategy across sprawling business segments. This execution risk is the most obvious of Citi’s challenges going forward as the milestones required to achieve the key performance indicators set out in Citi’s own 2020 valuation estimates require a coordinated effort across its geographically diverse business segments. Failing to bring down its efficiency ratio or deliver on its RoTCE expectations could weigh on the share price. External threats such as Citi’s tendency to become entangled in costly litigation or its exposure to emerging market volatility are both factors that have potential to negatively impact EPS growth.

Key Takeaways

With all that Citi has achieved in its turn around over the last 10 years, the risks facing the firm seem manageable when considered alongside the company’s numerous positive catalysts. Trading near its book value, Citi is the last great value opportunity in the U.S. banking sector. With a backdrop of rising interest rates, tax reform, lucrative emerging markets exposure and a robust U.S. economy, Citi is poised for healthy revenue growth. EPS should grow ~15% annually to 2020 as Citi continues to return capital to shareholders and reduce its number of shares outstanding. These tailwinds coupled with improving operating results will improve valuation and instill investor confidence. This compelling value opportunity offers investors of Citigroup Inc. a total return potential of ~23% annually with visibility towards continued dividend growth and a share price of ~$100 in 2020.

Disclosure: I am/we are long C.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

from Seeking Alpha Editors' Picks stocks https://ift.tt/2a97jA2

via IFTTT