Introduction/Recap:

On 5/9/2018, Prospect Capital Corp. (PSEC) reported quarterly net investment income (“NII”) of $0.195 per share, earnings per share (“EPS”) (also known as “net assets resulting from operations”) of $0.143, and a net asset value (“NAV”) as of 3/31/2018 of $9.227 per share. In comparison, I projected PSEC would report quarterly NII of $0.178 per share, EPS of $0.120 per share, and a NAV as of 3/31/2018 of $9.203 per share in the following article:

Prospect Capital's Fiscal Q3 2018 NII And NAV Projection (How Much Of A Decrease?)

When calculated, my NII, EPS, and NAV projections had a variance of $0.017, $0.023, and $0.024 per share, respectively. As such, I believe PSEC’s quarterly NII, EPS, and NAV fluctuations should be seen as a very minor-minor outperformance. PSEC’s NAV fluctuation was well within my projected range. Out of the seventeen quarters I have projected PSEC’s NAV within an article through Seeking Alpha, this was the fourteenth time the company’s NAV fluctuation was within my range.

I believe there were several notable events that occurred during the fiscal third quarter of 2018. This article will discuss how these events impact current and future operations. I will now summarize my prior article’s account projections and compare each account to PSEC’s actual results. I will discuss PSEC’s accounts in the same order as provided in my NII and NAV projection article (link provided above).

PSEC’s Projected Versus Actual Results (Overview):

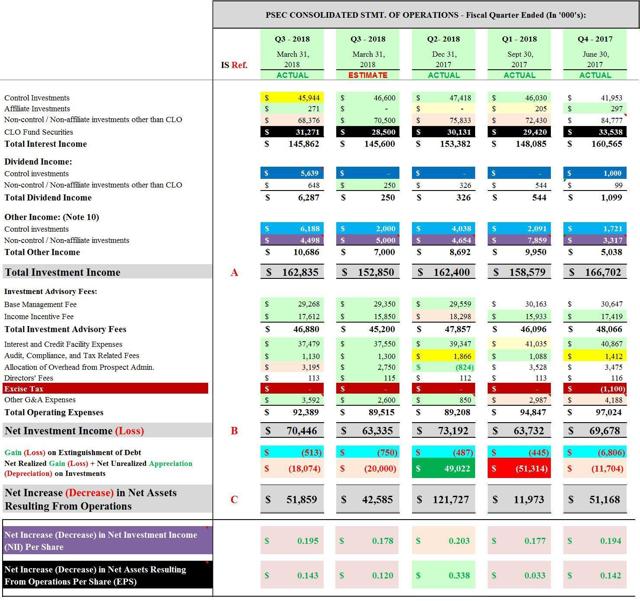

To begin this assessment analysis, Table 1 is provided below. Table 1 shows my prior account projections and compares these figures to PSEC’s actual results for the fiscal third quarter of 2018. For comparative purposes, I also include PSEC’s actual results from the prior three fiscal quarters (additional data/insight for readers).

Table 1 – PSEC NII and EPS for the Fiscal Third Quarter of 2018 (Actual Versus Projected)

(Source: Table created entirely by myself, partially using PSEC data obtained from the SEC’s EDGAR Database)

PSEC’s Income and Expense Accounts:

In my prior PSEC NII and NAV projection article, I projected the company would report an “average” amount of loan originations and add-on investments during the fiscal third quarter of 2018 when compared to levels experienced over the prior several years. I also anticipated PSEC would have a notably more “subdued” level of portfolio sales/repayments/restructurings when compared to the company’s prior fiscal quarter.

These two assumptions/projections came to fruition as PSEC reported loan originations and add-on investments of $430 million during the company’s fiscal third quarter of 2018 while reporting portfolio sales/repayments/restructurings of $118 million. When calculated, PSEC’s total investment portfolio increased $312 million for the fiscal third quarter of 2018 (prior to all quarterly “fair market value” [FMV] fluctuations and scheduled principle payments). When compared to my projected loan originations and add-on investments less portfolio sales/repayments/restructurings of $250 million, PSEC’s actual increase in the company’s investment portfolio was slightly greater. Most of this variance occurred within PSEC’s collateralized loan obligation (“CLO”) portfolio where the company increased its investment in a handful of existing securitizations. This event will be further discussed below.

Using Table 1 above as a reference, I projected PSEC would report “total interest income” of $145.6 million for the fiscal third quarter of 2018. In comparison, PSEC reported total interest income of $145.9 million. When calculated, this was a variance of only $0.3 million. This variance is mainly due to the following factors: 1) minor underperformance within the company’s non-control/non-affiliate portfolio; and 2) minor-modest outperformance within its CLO portfolio.

PSEC’s minor underperformance within the company’s non-control/non-affiliate investments was mainly due to the weighted average stated interest rate on most new loan originations. Simply put, I anticipated a slightly higher weighted average stated interest rate on PSEC’s newly originated loans versus the actual contractual terms.

PSEC’s minor-modest outperformance within the company’s CLO portfolio was mainly due to the fact management increased its investment in a handful of existing structured credit investments. In most cases, this was directly associated with a handful of refinancings/“resets” (extended reinvestment periods). Simply put, the specific amount of PSEC’s additional investment was not publicly disclosed prior to the filing of the company’s 10-Q. An increased investment directly equates to higher accrued interest income being recorded (when assuming yields remain constant). PSEC increased the company’s investment in the following CLO securitizations during its fiscal third quarter of 2018: 1) Apidos CLO XII, Ltd. (Apidos 12); 2) Apidos CLO XV, Ltd. (Apidos 15); 3) Brookside Mill CLO Ltd. (Brookside); 4) Voya CLO 2014-1, Ltd. (Voya 2014-1); 5) Octagon Investment Partners XVIII-R, Ltd. (Octagon 18); and 6) Romark WM-R Ltd. (Romark).

Moving down Table 1, PSEC’s dividend and structuring/fee income was a modest and minor outperformance, respectively. Regarding PSEC’s dividend income, I was encouraged to see the company generated this type of revenue stream during its fiscal third quarter of 2018. When looking at Table 1 over the past several quarters, this was the first time PSEC reported any meaningful amount of dividend income. A majority of PSEC’s dividend income came from the company’s equity investment in National Property REIT Corp. (“NPRC”). This portfolio company was able to record realized capital gains from its sale of two underlying properties. NPRC had sufficient earnings and profit (“E&P”) to make a distribution this quarter. I believe this event/recent trend should be seen as a positive factor and I would be even more encouraged if similar E&P distributions occur in the future (which management has not ruled out).

When PSEC’s total interest, dividend, and structuring/fee income are combined, I projected the company would report “total investment income” of $152.9 million for the fiscal third quarter of 2018. In comparison, PSEC reported total investment income of $162.8 million. When calculated, this was a variance of $10.0 million (rounded) which was towards the higher end of my stated range. Again, most of this variance was the additional accrued interest income within PSEC’s CLO portfolio (due to additional add-on investments) and the company’s dividend income through NPRC.

Still using Table 1 above as a reference, I projected PSEC would report “total operating expenses” of $89.5 million for the fiscal third quarter of 2018. In comparison, PSEC reported total operating expenses of $92.4 million. When calculated, this comes out to be a variance of ($2.9) million. This was within my stated range and should be considered a minor underperformance. Most of this variance is due to a higher than projected income incentive fee during the quarter. This was the direct result of additional income being accrued for within PSEC’s investment portfolio versus my projection (discussed above). Simply put, when PSEC’s investment income is greater when compared to my projection, the company’s income incentive fee will also be greater (direct relationship).

Continuing to move down Table 1, when all the amounts above are combined, I projected PSEC would report NII of $63.3 million for the fiscal third quarter of 2018. In comparison, PSEC reported NII of $70.4 million. When calculated, this was a variance of $7.1 million or $0.017 per share. As such, I believe PSEC’s reported NII was a minor-modest outperformance when compared to my projection. Most of this variance was the dividend income reported by PSEC during the quarter. Let us now discuss PSEC’s valuation accounts.

PSEC’s Valuation Accounts:

Continuing to move down Table 1, I projected PSEC would report a “gain (loss) on the extinguishment of debt” of ($0.8) million for the fiscal third quarter of 2018. In comparison, PSEC reported a loss on the extinguishment of debt of ($0.5) million. Due to this immaterial variance (less unamortized fees being “trued-up” upon realization), further discussion of this account is deemed unwarranted.

I believe PSEC’s entire investment portfolio, from a valuation perspective, performed “in-line” with my expectations during the company’s fiscal third quarter of 2018 which ultimately led to the company reporting EPS of $0.143 when compared to my projection of $0.120. This directly led to PSEC reporting a NAV as of 3/31/2018 of $9.227 per share versus my projection of $9.203 per share. Most of this minor variance was already accounted for within PSEC’s NII amount.

I projected PSEC would report a combined net realized loss and unrealized depreciation of ($20.0) million during the company’s fiscal third quarter of 2018. In comparison, PSEC reported a combined net realized loss and unrealized depreciation of ($18.1) million. When calculated, I believe this $1.9 million variance was basically an “exact match” due to the sheer size of PSEC’s investment portfolio as of 3/31/2018 ($5.72 billion).

I correctly projected PSEC’s CLO portfolio would continue to experience a net decrease in valuation and some of the company’s control investments would directly/indirectly benefit from the recent passage of the Tax Cuts and Jobs Act (“TCJA”). Still, let us take a deeper look at these areas of PSEC’s investment portfolio.

1) PSEC’s CLO Portfolio:

As stated in my PSEC NII and NAV projection article (link provided above), I correctly anticipated a majority of the company’s CLO investments (especially older/legacy securitizations) would continue to experience a decrease in current yields/projected future discounted cash flows, hence negatively impacting valuations. However, contrary to recent trends over the prior two years, some of PSEC’s CLO investments actually experienced a net increase in current yields during the company’s fiscal third quarter of 2018. This was particularly true within most of PSEC’s CLO investments that recently experienced refinancings/resets/re-issues.

When analyzing PSEC’s CLO portfolio, market participants need to consider there was a continued “flattening” of the forward U.S. London Interbank Offered Rate (LIBOR) curve during the calendar first quarter of 2018. This factor partially offset broader CLO price stability-minor increases during the quarter. On the liability side of the equation per se, due to the fact most of a CLO’s liabilities are “floating-rate” in nature (which are directly tied to current/spot U.S. LIBOR), including the fact that most investments currently have cash LIBOR floors of say 1% (typically higher floors with more vintage securitizations), an increase in current/spot U.S. LIBOR up to a certain percentage actually negatively impacts current and projected near-term discounted cash flows. However, during the calendar second quarter of 2017, most cash LIBOR floors were surpassed which partially helped mitigate the severity of decreases in cash flows stemmed from continued yield/spread compression (discussed next).

On the asset side of the equation, continued spread/yield compression has negatively impacted overall investment returns within theses securitizations. This is mainly due to prepayments/refinancing of higher-yielding debt investments which are being replaced by lower-yielding debt investments (or not replaced at all in the recent/current environment). Due to the fact all of PSEC’s current CLO investments are within the equity tranche (residual interests/subordinated notes) of these securitizations, the recent spread/yield compression has negatively impacted overall yields within this portfolio to a greater degree.

PSEC’s CLO residual interests/subordinated notes are in the “lowest tranche/bottom basket” when it comes to income distributions. If there is a noticeable uptick in underperforming/non-performing loans (defaults) and/or a material decrease in the weighted average interest rate associated with the underlying loans that make up a particular securitization (which has recently been occurring), the residual interest (equity) tranche of a CLO bears first risk loss of this income. This methodology is known as a CLO’s “waterfall” calculation which I have discussed at length in prior PSEC articles. This is why this particular tranche of the CLO can have highly attractive yields under certain positive environments/life cycles (say north of 25%) yet also have very poor yields under certain negative environments/life cycles (say single digit or even no yield).

This all gets back to an investment’s “risk versus reward” metric. Within a CLO’s residual interest/equity tranche, there is heightened risk for poor investment returns but also a heightened reward if the securitization is performing above expectations. One also needs to consider a securitization’s lifecycle when understanding/projecting interest income and valuation fluctuations. Furthermore, other-than-temporary impairments (“OTTI”) that recently occurred within several CLO investments are good examples of what could occur within equity tranches of certain older/legacy securitizations.

I projected PSEC’s CLO portfolio would record net unrealized depreciation of ($30) million for the fiscal third quarter of 2018. In comparison, PSEC recorded net unrealized depreciation of ($25) million. Due to the size of PSEC’s CLO portfolio (FMV of $945 million as of 3/31/2018), I believe a $5 million variance is a minor outperformance. As discussed earlier, PSEC had increased the company’s investment in six CLO securitizations during the fiscal third quarter of 2018. PSEC’s actual valuation fluctuations within these securitizations were generally more favorable versus my projection.

Analyzing a CLO portfolio is a methodology that constantly needs to be “tweaked”. As is the case with all my mortgage real estate investment trust (mREIT) and business development company (“BDC”) research, I continuously evaluate all applicable factors/variables that go into a modeled projection. In this instance, this includes a non-simulated future discounted cash flow projection, various modeled forecasts through a privately accessed intranet valuation software (includes “Monte Carlo” modeling), and comparable research tools/models from outside resources (including Intex).

I continue to stress to readers valuing a CLO portfolio is not an “exact science”. This is dealing with various imputed factors/variables and providing certain “judgments”. That is why these types of investments are classified as level 3 assets per Accounting Standards Codification 820 (ASC 820) which I have continued to reiterate since I began covering PSEC over five years ago. In the end, if a company were to engage three independent valuation firms, I believe each firm will likely derive three different valuation ranges for a particular portfolio (though a partial overlap of these three ranges would likely occur). Currently, that’s just the “grim reality” that investors/market participants have to deal with regarding these types of more illiquid investments/securitizations. Let us now move on to the next area of PSEC’s investment portfolio.

2) PSEC’s Control Investments:

Finally, there were several modest-notable FMV fluctuations when it came to PSEC’s control investments. This includes taking into consideration the macroeconomic impacts from passage of the TCJA. I would like to “hone in” on the following two control investments: 1) First Tower Finance Company LLC (First Tower); and 2) Freedom Marine Solutions, LLC (Freedom Marine).

When it comes to First Tower, I projected PSEC would record net unrealized appreciation of $8 million for the fiscal third quarter of 2018. In comparison, PSEC recorded net unrealized appreciation of $14 million. When calculated, this was a variance of $6 million which I believe should be considered a minor-modest outperformance from a valuation perspective. While I certainly agree First Tower should directly benefit was passage of the TCJA (and a more “robust” economy as a direct result of tax reform), I believe PSEC’s valuation adjustment during the fiscal third quarter of 2018 was “bullish”. I made a similar comment about First Tower last quarter. The following quote from PSEC’s 10-Q for the fiscal third quarter of 2018 was provided by management as the main reasons for the net unrealized appreciation:

“…The increase in fair value was driven by First Tower’s acquisition of Harrison Finance, a consumer finance company, as well as increases in trading multiples of comparable companies…”

While an increase in trading multiples of comparable companies is certainly “one” measure to consider when determining an appropriate valuation of a company, I would first like to see improved operational performance by First Tower itself prior to the continued increase in valuation. Remember, last quarter, PSEC increased First Tower’s valuation by $33 million. Looking ahead, I am currently anticipating a decrease in the valuation growth of First Tower over the foreseeable future (this assumes no additional acquisitions occur). However, I was pleased that 100% of First Tower’s recorded payment-in-kind (“PIK”) income was received in cash during the quarter (as opposed to being capitalized/deferred).

Regarding Freedom Marine, this portfolio company owns/operates/manages transport and support vessels in the Gulf of Mexico. Due to the fact crude oil prices have recently quickly increased, most companies within the oil and gas/energy sector have been reporting lower operating losses/enhanced profitability over the past several quarters. Even though some oil and gas/energy companies have not increased capital expenditures by the same proportion of recent revenue/profitability growth, I would assume recent price increases would eventually lead to increased productivity across this generalized sector (including Freedom Marine’s “niche” space).

As such, I believe it was disappointing to read PSEC recorded certain asset impairments within Freedom Marine during the company’s fiscal third quarter of 2018 which ultimately led to net unrealized depreciation of ($13) million being recorded. In comparison, I anticipated a very minor quarterly valuation fluctuation (less than $1 million) within this portfolio company. This should be viewed as a “cautionary”/negative trend though I am anticipating this weakness is isolated to this specific portfolio company.

When analyzing PSEC’s entire investment portfolio, I had the following (undervaluations) overvaluations when compared to the company’s reported FMV fluctuations during the fiscal third quarter of 2018: 1) CLO portfolio by ($5) million; 2) First Tower by ($6) million; 3) Freedom Marine by $13 million; and 4) the remainder of the company’s investment portfolio by ($4) million. Again, when analyzing PSEC’s valuation fluctuations across the company’s entire investment portfolio, I believe the company matched my expectations. However, as noted above, there were a couple portfolio companies that underperformed/outperformed my expectations.

Conclusions Drawn:

Readers have continued to request that I provide these types of “update/follow-up” articles showing how my quarterly projections “stacked-up” to PSEC’s actual results. I believe the analysis above accomplishes this request. Since a company’s operating performance (quarterly earnings) is one of the key drivers to stock price valuations, I believe these types of projection/assessment articles are appreciated by most readers (owners and non-owners of PSEC alike). In addition, this article provides my overall (and in my opinion non-bias) thoughts on the quarter which I believe most readers see as beneficial when assessing certain investing strategies.

From the analysis provided above, I believe it was determined PSEC’s NII, earnings, and NAV per share figures were a very minor-minor outperformance when compared to my expectations. PSEC’s NII was a minor outperformance while the company’s valuation fluctuations within its investment portfolio, as a whole, matched my expectations.

For readers curious about PSEC’s dividend sustainability (after the notable reduction back in September 2017), please see the following article as to why I correctly projected the company would maintain its dividend per share rate for May-August 2018 (contrary to some other viewpoints):

My next PSEC dividend sustainability article will be available to readers prior to the company’s next set of dividend declarations (prior to August 2018). This future article will include my PSEC estimated quarterly net investment company taxable income (“ICTI”) and cumulative undistributed taxable income (“UTI”) balances.

My BUY, SELL, or HOLD Recommendation:

In my opinion, the following positive factors/catalysts should be highlighted for existing and potential PSEC shareholders: 1) continued relative price stability within the high yield debt market (positively impacts valuations where credit risk remains low; even with broader market volatility in January-February 2018); 2) quarterly economic returns being generated in most quarters; 3) recent refinancing/resets/re-issues of some CLO investments (positively impacts projected future discounted cash flows); 4) continued strong cumulative performance regarding several control investments (including positive impacts from recent passage of the TCJA); 5) continued modest exposure to the oil and gas sector when compared to the BDC peers I currently cover (positive since prices have reversed course and moved notably higher in recent months [Freedom Marine aside]); 6) continued extremely low exposure to the retail sector (only exposure within CLO investments [some parts of retail sector negatively impacted by continued change in consumer behavior/trends]); 7) continued high percentage of floating-rate debt investments (88% as of 3/31/2018); 8) continued extremely high percentage of fixed-rate liabilities (96% as of 3/31/2018); 9) recently called/soon-to-be maturing higher-cost debt; 10) insiders have not sold any shares of the company since I began covering this stock (since 2013); 11) recent improved operations within several once struggling investments (Spartan Energy Services, Inc. and Venio LLC were taken off non-accrual status during the fiscal second quarter of 2018); 12) $0.06 per share monthly dividend has a high probability of being maintained over the foreseeable future; and 13) fairly recent insider purchases by several members of the executive management team (especially John Barry).

However, the following cautionary/negative factors should cause heightened awareness for existing and potential PSEC shareholders: 1) continued suppressed dividend and structuring/fee income (excluding any one-time fees associated with certain sales [will continue to monitor NPRC’s distributions and remove this factor if dividend income continues]); 2) recent elevated amount of loan prepayments due to refinancing with other market participants or impacts with current corporate interest deductibility (including negotiated lower stated interest rates with existing portfolio companies - negatively impacts NII); 3) continued modest-material depreciation within several control/non-control investments and increase in non-accruals during 2016-2017; 4) “non-amendment” of the company’s Investment Advisory Agreement with Prospect Capital Management L.P. (regarding the “2%/20%” fee structure) or any type of waived base management fees; 5) above average weighted average cash U.S. LIBOR floor and cost of funds rate when compared to sector peers (though higher floor less of an issue as short-term rates/yields continue to net increase); 6) continued low cumulative UTI to help offset any future quarterly net ICTI overpayments (continue to project the company’s net ICTI will be more stable during tax year 2018 though); 7) recent notable net decrease in current GAAP yield within some of the company’s CLO investments (mainly due to maturing/aging securitizations and spread/yield compression; negatively impacts both accrued interest income and valuations); 8) continued lack of “notable” utilization of the company’s lower-cost $885 million revolving credit facility (negatively impacts interest expense); 9) lack of recent share repurchases initiated by the company itself (excludes insiders; would continue to be accretive to NAV); and 10) recent increase in the number of shares issued in relation to the dividend reinvestment plan (currently has a dilutive impact to NAV).

PSEC recently closed at $6.62 per share as of 5/11/2018. This was a ($2.61) per share discount to PSEC’s NAV as of 3/31/2018 of $9.23 per share. This calculates to a price to NAV ratio of 0.7174 or a discount of (28.26%).

With the analysis above as support, I currently rate PSEC as a SELL when the company’s stock price is trading at less than a (15.0%) discount to its NAV as of 3/31/2018, a HOLD when trading at or greater than a (15.0%) but less than a (25.0%) discount to its NAV as of 3/31/2018, and a BUY when trading at or greater than a (25.0%) discount to its NAV as of 3/31/2018. These recommendation ranges are unchanged when compared to my last PSEC article (approximately three weeks ago).

As such, I currently rate PSEC as a BUY (however, fairly close to my HOLD range). My current price target for PSEC is approximately $7.85 per share. This is currently the price where my recommendation would change to a SELL. This price target is a $0.05 per share increase when compared to my last PSEC article. The current price where my recommendation would change to a HOLD is $6.90 per share. This price is unchanged when compared to my last PSEC article.

Simply put, I believe PSEC’s current valuation could be an attractive entry point for some valued-orientated investors with a higher risk tolerance. To remain non-bias, more cautious investors should likely look elsewhere for a potential equity investment.

Final Note: Each investor's BUY, SELL, or HOLD decision is based on one's risk tolerance, time horizon, and dividend income goals. My personal recommendation will not fit each reader’s current investing strategy. The factual information provided within this article is intended to help assist readers when it comes to investing strategies/decisions.

Current BDC Sector Stock Disclosures:

On 8/27/2015, I initiated a position in PSEC at a weighted average purchase price of $7.325 per share. On 2/8/2016, I increased my position in PSEC at a weighted average price of $5.445 per share. My second purchase was approximately double the monetary amount of my initial purchase. When combined, my PSEC position had a weighted average purchase price of $6.072 per share. This weighted average per share price excluded all dividends received/reinvested. On 3/2/2016, I sold my entire PSEC position at a weighted average sales price of $7.495 per share as my price target, at the time, of $7.50 was met that day. Each PSEC trade was disclosed to readers in real time (that day) via the StockTalks feature of Seeking Alpha.

On 9/6/2017, I re-entered a position in PSEC at a weighted average purchase price of $6.765 per share. On 10/16/2017 and 11/6/2017, I increased my position in PSEC at a weighted average purchase price of $6.285 and $5.66 per share, respectively. When combined, my PSEC position has a weighted average purchase price of $6.077 per share. This weighted average per share price excludes all dividends received/reinvested. Each PSEC trade was disclosed to readers in real time (that day) via the StockTalks feature of Seeking Alpha.

On 2/2/2018, I initiated a position in Main Street Capital Corp. (MAIN) at a weighted average purchase price of $37.425 per share. On 2/5/2018, I increased my position in MAIN at a weighted average purchase price of $35.345 per share. My second purchase was approximately triple the monetary amount of my initial purchase. On 3/1/2018, I increased my position in MAIN at a weighted average purchase price of $35.365 per share. When combined, my MAIN position has a weighted average purchase price of $35.729 per share. This weighted average per share price excludes all dividends received/reinvested. Each MAIN trade was disclosed to readers in real time (that day) via the StockTalks feature of Seeking Alpha.

All trades/investments I have performed over the past several years have been disclosed to readers in real time (that day at the latest) via the StockTalks feature of Seeking Alpha (which cannot be changed/altered). Through this resource, readers can look up all my prior disclosures (buys/sells) regarding all companies I cover here at Seeking Alpha (see my profile page for a list of all stocks covered). I encourage other Seeking Alpha contributors to provide real time buy and sell updates for their readers which would ultimately lead to greater transparency/credibility.

Disclosure: I am/we are long PSEC, MAIN.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

from Seeking Alpha Editors' Picks stocks https://ift.tt/2a97jA2

via IFTTT