Over the course of the past few months, we’ve been looking at special situations within the energy space - specifically, bankruptcy reorganizations. Many of these smaller E&Ps have had a combination of over-leveraged balance sheets, poor rock characteristics, and inefficient operating structures. And though we recently invested in a few of these reorgs, we feel SandRidge (NYSE:SD) is the best-positioned among this opportunity set, with a hard catalyst to outperform in the near term. There are potential drivers in days/weeks that should alleviate some of the valuation gap that we and others perceive.

Opportunity

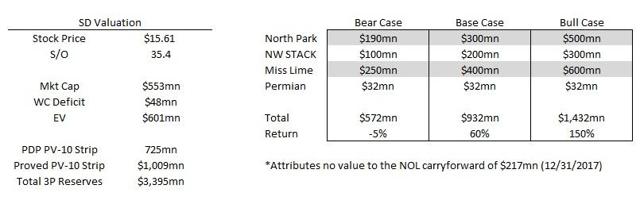

SandRidge year to date has lost roughly 25%, while XOP (oil & gas exploration and production ETF) is up roughly 6%. Furthermore, since coming public after emerging from bankruptcy, SandRidge is down roughly 35% - all during a significant oil price recovery period. There are a number of factors at play that have caused this price discrepancy, including limited sell-side coverage, bond holders becoming forced sellers, lack of inclusion in ETFs, and lack of trust from the investment community. So, while the company has had a checkered past, we believe the assets have become so neglected by the investment community that with conservative assumptions, the stock could be 100-150% higher on a sum-of-the parts basis.

While a sum-of-the-parts thesis is nice, we typically avoid situations where there is not a clear path on how the gap will eventually narrow. We feel most of that concern is mitigated with multiple parties engaging SandRidge in an attempt to gain control. Furthermore, at the end of the day, if there is a change of control event, it will likely be at a 30-50% premium to today’s valuation.

Key Points on SandRidge

- On February, 6th 2018, MidStates Petroleum (NYSE:MPO) attempted to merge with SandRidge in an all-stock transaction, with a 60/40 split on ownership and SandRidge investors getting the lion’s share. At the time, MidStates Petroleum stated targeted annual synergies would be roughly $70 million, with significant overlapping Mississippi Lime (Miss Lime) acreage and infrastructure. We think this was an opportunistic merger proposal that significantly undervalued SandRidge’s asset position and didn’t account for the quality and depth of the company's Miss Lime assets. No merger was agreed upon, and it was rejected by SandRidge management.

- Icahn made a comment in April about making an all-cash offer upon due diligence; Icahn’s average price is $17.16.

- In the upcoming vote, Icahn is likely to get substantial influence, if not control of the BOD.

- The North Park asset was acquired about three months before the absolute bottom in crude spot prices at $190 million; we think that asset alone is worth significantly more than that sum, likely $400 million+ in today’s oil environment.

- The newly put in place management team seems adamant about selling the entire company and has signed confidential agreements with 17 potential bidders for the assets.

- We think the Mississippi Lime assets are potentially worth more than the entire enterprise value of SandRidge based on transactions in the past few months.

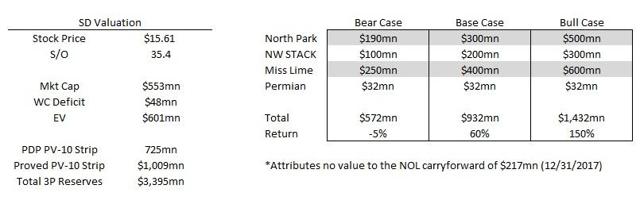

- Extremely attractive valuation, $725 million PDP PV-10 strip, $1,009 million PV-10 proved, versus roughly a $550 million market cap.

Quick Background

SandRidge is an E&P company that has had quite a dramatic history since its transformation in 2006 by former Chesapeake (NYSE:CHK) co-founder Tom Ward. At the company’s pinnacle, it had a market capitalization of over $11 billion; today, after bankruptcy reemergence, it has an enterprise value a tad over $500 million with no debt. Tom Ward (and family) was associated with significant capital allocation missteps as well as questionable activities at SandRidge during his tenure. Ward was ousted in an activist campaign by TPG Axon, Omega Advisors, and others in June 2013; he departed with a handsome severance package north of $90 million.

While the activist campaign made sense in theory, the over-leveraged capital structure and aggressive production growth prior to the cycle’s turn cemented SandRidge’s fate. The company filed bankruptcy in May of 2016, just a few months after oil had bottomed, with over $3.7 billion in debt. Emerging from bankruptcy in October of 2016, SandRidge shed the $3.7 billion in debt and approximately $300 million in annual interest payments. Today, its balance sheet is unlevered, with only a small working capital deficit and significant free cash flow from the legacy Mississippi Lime production.

Although SandRidge exited from bankruptcy with essentially a clean slate, it has not been a smooth ride since coming public. James Bennett (former SD CEO), who was put in to replace Ward, oversaw the bankruptcy of SandRidge and managed to retain the CEO title upon emergence from bankruptcy in 2016. Subsequently, his tenure after the bankruptcy was equally as painful to watch, with the stock falling over 30% in the face of a sharp rally in spot crude prices. Another highlight of Bennett’s tenure was the proposed acquisition of Bonanza Creek (NYSE:BCEI); prior to this proposal, the strategy from Bennett and the C suite had been to protect the balance sheet and utilize a methodical return on capital approach to drill and delineate SD’s large acreage holdings. This spur of the moment deal went in direct opposition to management’s laid-out strategy and offered no real synergies, and it diluted per share reserves, production, and cash flow. The strategy change drew the ire of Icahn and other shareholders who were instrumental in firing Bennett in February of this year. In our opinion, the only thing Bennett did right during his tenure was make a prescient acquisition within three months of the oil bottom in a privately negotiated transaction for a large contiguous acreage position in Colorado’s North Park basin.

Assets

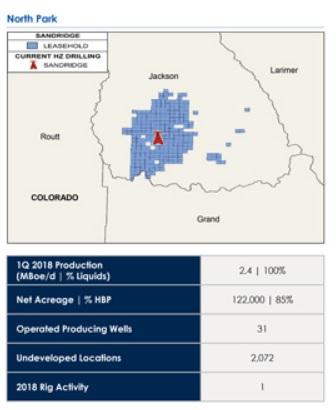

North Park (122,000 net acres, 85% HBP)

(Source: SandRidge Shareholder Discussion Materials, 06/04/2018)

North Park was acquired on November 4th of 2015 from EE3 in a privately negotiated transaction for $190 million; management estimated at the time of purchase the well level returns were ~33% using the strip pricing. At that point in time, spot crude oil prices were below $40 and EE3 was likely under pressure from their private equity sponsor, Yorktown Energy Partners, to realize the value sooner rather than later. In fact, EE3 executives made a comment as early as 2013 that the asset was for sale “at the right price.”

The North Park Basin is concentrated in the Niobrara shale play, which has similar geologic characteristics to the DJ Basin Niobrara - with five stacked benches at depths of 5,500-9,000 feet. In fact, some recent well results are on par with some of the best DJ Basin wells. The acreage is largely concentrated in rural north central Colorado and is ideal for pad drilling, given the mostly contiguous 122k net acres. So far, SandRidge has delineated three Niobrara benchmarks (B, C, and D) as commercially viable. There are a few issues with the asset, including no takeaway infrastructure or processing facilities for natural gas; currently, all natural gas is being flared. Additionally, all oil production is transported using trucks, which costs ~$3.00 per barrel. A large portion of the acreage is under federal lease hold positions, and there are required periods of delay associated with regulatory stipulations and infrastructure build-out that will impact new drilling completion and timing. Due to its large infrastructure needs, management has stated that the North Park Basin is ideal for a JV partnership. We believe this is an asset that a larger-scaled E&P could acquire and then develop the needed infrastructure to lower per barrel transportation costs as well as put pipe in place to realize NGL and gas sales.

The North Park Basin is currently producing, at the end of Q1, 2,325 Bopd (management guided for a Q3 ‘18 exit rate of ~4,000 Bopd) when acquired; this asset was producing only roughly 850 Bopd, given a 15% gas weight. On top of this, there is some much-needed infrastructure being put in place with a small-scale GTL processing facility under contract at the Big Horn tank battery. This facility will be built and operated at no cost to SandRidge; the company, in turn, will share in the liquids recovery from this processing. Initially, this facility will process ~500 Mcf per day upon installation in 2019. Furthermore, the company may evaluate additional pipeline takeaway and contemplate potential future expansions to the GTL facilities.

Another asset, we think, that is very comparable to North Park is the DJ Basin (Wattenburg field) - the core of which is located about 150 miles southeast of the North Park basin. Reservoir characteristics of the Niobrara in the North Park Basin are similar to those of the Niobrara in the DJ Basin to the east of North Park, with the Niobrara consisting of multiple stratigraphic benches. On a per acre value, a recent top-tier DJ Basin deal was made by SRC Energy, buying 30,000 acres at $17,000 per acre from Noble, whereas average acreage values for the DJ Basin are more in line around $12,000/acre. We think a conservative $4,000-5,000 per acre (third-party source) for a contiguous land block in the North Park basin is reasonable; that would put the current valuation at roughly $550 million.

NW STACK (72,500 net acres, 52% HBP)

SandRidge owns 72,500 net acres in the NW STACK, while outside of the core STACK window; the NW STACK has recently been in greater focus as adjacent operators continue to delineate the play with some success. The Meramec and Osage formations are the primary targets in the NW STACK, and are currently being targeted using horizontal well technology in Garfield, Major, Dewey, and Woodward Counties. In February 2017, SandRidge added additional bolt-on acreage: a deal for 13,000 net acres in Woodward County, Oklahoma, for approximately $47.8 million in cash, as well as interests in four wells previously drilled on the acreage. We think the southern half of SandRidge’s NW STACK acreage can generate high returns on average (management states >50% IRRs), while much of it is still prospective and requires further delineation. Estimated D&C costs in the NW STACK run roughly $4.4 million and $6.5 million per well, respectively, for 5K and 10K ft laterals. On average, the wells are decent, considering the lower D&C costs in the basin; the most recent four wells had IP 30’s of 675 Boe/d (76% oil).

Thus far, SandRidge has focused on the Meramec formation, which has a higher oil weight than the Osage formation. While still commercially viable, the Osage is typically producing about 40-50% oil, versus the Meramec, which on average is producing around 70%+ oil.

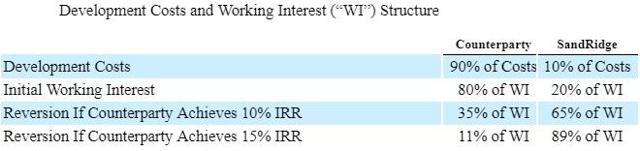

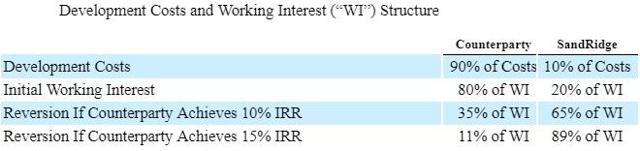

While in this delineation stage, SandRidge executed an attractive drilling participation agreement in Q3 2017 for $200 million, which is divided into two separate $100 million tranches. While expensive, the Drillco serves three purposes: it helps hold additional acreage by production, adds low-cost reserves, and keeps capital commitments low while SandRidge utilizes the majority of its capex on the North Park Basin development. Furthermore, the Drillco agreement helps de-risk some of the prospective NW STACK, improving the technical knowledge of the formation for future higher net working interest drilling locations.

The drilling participation agreement is as follows:

(Source: 2017 10-K)

Mississippi Lime (360,000 net acres, 95% HBP)

The Miss Lime formation is an expansive carbonate hydrocarbon system located on the Anadarko Shelf in northern Oklahoma and southern Kansas, and is a target for exploration and development within the Mid-Continent. SandRidge alone, over the past decade, has put billions into drilling and completions as well as significant saltwater disposal systems and electrical infrastructure in the basin. There is significant cash flow coming off this asset, with over 1,100+ operated wells. Due to some delays in the North Park capital program, management has decided to shift more capital to the Miss Lime and drill four wells, spending about $11 million in D&C in 2018.

While it is challenging to value this vast acreage position in the Mississippi Lime, we think there is significant hidden value in the infrastructure assets to a strategic buyer like MPO. SandRidge has spent considerable capital on over 1,250 miles of power lines, six substations, two micro grids, 1,095 miles of SWD infrastructure, and 136 active disposal wells. We believe this is the very reason that MPO put combined company synergies to be around $70 million per annum. Since the company has just entered into a recent deal to sells its interest in the NW STACK, we think that almost all of those synergy benefits were directly attributable to the Miss Lime. One could make an argument for a $5-10 million haircut for SG&A and other overall overhead synergies, thus putting the combined synergy value on only the Miss Lime to be ~$60-65 million. We think a strategic buyer would easily pay 7x the synergy amount ($440 million), particularly because of the hundreds of millions of dollars SandRidge has invested in infrastructure assets in the Miss Lime, as well as the significant cash flow generation from the existing 1,100+ operating wells. Given that roughly 80% of SandRidge’s total production is coming from the Miss Lime, this asset generates the majority of the $171 million in forward adj. EBTIDA. On almost any proportional multiple of EBITDA, one would also arrive at a similar $400-550 million valuation.

On a recent transaction basis, Tom Ward’s new entity, BCE-Mach LLC, acquired 155,000 net acres (02/07/2018) as part of a three-way sale of 238,000 net acres for $500 million from Chesapeake. While individual transaction details were not released, based on the information we have, it appears it was done at roughly $2,100 per acre, or $21,739 per Boe/d in total. We estimate SD’s Miss Lime acreage should do around 25,000 Boe/d (Q1 exit rate of ~28,000 Boe/d) for FY ’18 on average; so on a production-adjusted basis, this puts the value around $543 million, or the entire market value of SandRidge (and this is not including a valuation for the additional acres.) If one was to give credit for the remaining 122,000 additional net acres owned by SandRidge at a value of ~$400/acre, that would be an incremental $49 million, or ~$600 million in total, just for the Mississippi Lime position.

This transaction is about as apples-to-apples as it gets; first, the Chesapeake acreage sold directly overlaps with the core Miss Lime position and infrastructure of SandRidge in the Woods and Alfalfa counties (see below), as well as the adjacent counties of Grant, Garfield, Harper, Barber, and Sumner. Furthermore, the Chesapeake assets had in place significant saltwater disposal assets as well as some in-place electrical infrastructure, very similar to SandRidge. Tom Ward, the former long-time CEO of SandRidge, is probably the most familiar with these assets, and if SandRidge were to pursue an outright sale of the Miss Lime position, we think this would attract significant interest from Ward’s investment vehicle.

(Source: SandRidge 02/22/2018 Investor Presentation)

Permian Basin

The Permian Basin represents roughly 3.6% of total production in Q1 ’18, that is SandRidge’s proportional share of its 25% ownership stake in the SandRidge Permian trust assets listed on the NYSE under PER. This stub represents an approximate market value of roughly $32.25 million.

Comps

Valuation

Conclusion

On a sum-of-the-parts basis, we think this is one of the most compelling bankruptcy reorgs with a catalyst. SandRidge acquired the North Park asset in the depths of the oil crisis for $190 million, which we believe was a cheap price based on the conversations we’ve had with experts in the field. While there are certainly some issues with the asset, we think the price more than discounts those concerns. In light of all these variables, we think that the North Park asset alone is worth between $350 million and $500 million.

The NW STACK acreage is perhaps a little more difficult to value, given it is more prospective and has yet to be fully delineated. We believe that a conservative valuation would put these 72.5k net acres in the valuation range of $175-275 million; this is a fairly wide range, but we think this asset has the potential to deliver substantial IRRs at the well level. Also keep in mind that a large part of the heavy lifting will be done utilizing the Drillco agreement. This should help SandRidge by increase its technical ability for future well design improvements.

We think the Mississippi Lime assets represent the most undervalued asset in the portfolio. On pretty much any metric, the Miss Lime screens absurdly cheap - on an adjacent transaction basis, on an EBITDA multiple/FCF basis, or on a per acre valuation basis (including the infrastructure assets). Part of the reason these asset are able to generate decent returns at the current strip is due to the billions invested prior to bankruptcy in infrastructure and D&C. This large existing base of legacy wells generates significant cash flow that is currently being reinvested into the NW STACK and North Park, which will, over time, increase SandRidge’s exposure to higher-margin oil production.

This is a rare opportunity where a recent bankruptcy, a lack of sell-side coverage, significantly lower liquidity, and bondholder liquidations have put structural pressure on the shares that has obfuscated the true value of the combined assets. While Icahn and MPO have been in heated negotiations, one thing has become very clear to us: all these individual parties are fighting over the same thing - the tremendous valuation disparity that exists between the individual assets and what a private buyer or strategic would pay. Overall, we think an investor is paying ~40-50 cents on the dollar for assets that are likely to get a bid significantly higher within weeks.

Risks

- Crude prices fall further.

- Icahn (or other entity) takes most of the economics of the undervalued assets away from minority shareholders.

- Potential capital destructive deals that dilutes SandRidge’s depressed multiple.

- A focus on production growth at any cost over return on investment approach.

Disclaimer: This report is intended for informational purposes only and you, the reader, should not make any financial, investment, or trading decisions based upon the author's commentary. Although the information set forth above has been obtained or derived from sources believed to be reliable, the author does not make any representation or warranty, express or implied, as to the information's accuracy or completeness, nor does the author recommend that the above information serve as the basis of any investment decision. Before investing in a security, readers should carefully consider their financial positions and risk tolerances to determine if such a stock selection is appropriate.

At any time, the author of this report may trade in or out of any securities that are mentioned in the report as long or short positions in his own personal portfolio or in client portfolios that he manages without disclosing this information. At the time this report was published, the author had a long position in SD either in his personal account or in accounts that he managed for others.

Disclosure: I am/we are long SD.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

/cdn.vox-cdn.com/uploads/chorus_asset/file/11595355/dseifert_180625_2693_0009.jpg) Surface Go vs. Surface ProPhoto by Dan Seifert / The Verge

Surface Go vs. Surface ProPhoto by Dan Seifert / The Verge

/cdn.vox-cdn.com/uploads/chorus_asset/file/11595351/dseifert_180625_2693_0005.jpg) Surface Go kickstandPhoto by Dan Seifert / The Verge

Surface Go kickstandPhoto by Dan Seifert / The Verge